Elon Musk, already the world’s wealthiest person, is making headlines once again — not for launching rockets or advancing AI, but for seeking a record-breaking pay package from Tesla potentially worth $1 trillion. But according to the billionaire CEO, this isn’t about boosting his net worth — it’s about securing control of the company he helped build.

“It’s not like I’m going to go spend the money,” Musk told investors during a Wednesday call. “There needs to be enough voting control to give (me) a strong influence – but not so much that I can’t be fired if I go insane.”

Why Musk Says He Needs More Shares

The proposed package — the largest in corporate history — would grant Musk options to buy up to 423.7 million additional shares of Tesla stock if the company hits ambitious performance targets over the coming years. If Tesla’s market value soars accordingly, the options would be worth nearly $1 trillion.

Musk says he needs that stake not for personal wealth, but to protect Tesla from external influence — particularly from proxy advisory firms ISS (Institutional Shareholder Services) and Glass Lewis.

“[They’re] corporate terrorists,” Musk said bluntly on the investor call, accusing the firms of making recommendations that could “destroy the future of the company.”

Both firms reportedly advised against Musk’s new pay package, just as they did with his controversial 2018 compensation plan, which was later thrown out by a Delaware judge. Despite that, Tesla shareholders re-approved a version of the plan in a June 2024 vote — with 84% of non-Musk-held shares voting in favor.

What Makes This Package Different

Musk currently owns 413 million Tesla shares outright and has options to purchase 304 million more — though those options have been challenged in court. Even with that ownership, Musk holds about 16% of Tesla’s outstanding shares. He says he wants to increase that stake to 25%, citing it as the level of influence he needs to steer the company’s direction while remaining “fireable” if needed.

The board’s case for approving the new compensation plan is simple: incentivize Musk to stay focused on Tesla amid a long list of competing ventures, including:

SpaceX, where he serves as CEO

xAI, his artificial intelligence company

X (formerly Twitter), which he owns and leads

Neuralink, a brain-machine interface startup

The Boring Company, his tunneling infrastructure firm

With so many competing interests, Tesla’s board argues that retaining Musk’s attention is critical to Tesla’s future. In its proxy statement, the board wrote:

“Retaining and incentivizing Elon is fundamental to Tesla achieving these goals and becoming the most valuable company in history.”

Critics Say It’s Too Much — Again

Despite the board’s support and shareholder approval last year, Musk’s pay has not been without controversy. The original 2018 package — structured similarly to the new one — was struck down in January 2024 by a Delaware judge who ruled it was not in the best interests of shareholders.

Critics say the scale of Musk’s proposed rewards are excessive, even if tied to performance milestones. Shareholder advisory firms ISS and Glass Lewis have again recommended voting against the new plan, citing governance concerns and the sheer size of the payout.

Musk, however, sees the influence of these firms as dangerous.

“I just don’t feel comfortable building a robot army here and then being ousted because of some asinine recommendations,” Musk said. “They have no freaking clue.”

Musk claims index funds, which hold a large portion of Tesla stock, often follow proxy advisors’ guidance without question — an influence he believes could derail Tesla’s strategic direction.

What Happens If the Package Is Approved?

If the package passes — and Tesla’s market cap climbs to the valuation targets — Musk would hold a significant minority stake, giving him substantial control without total ownership. The pay package includes milestone-based options, meaning he only benefits if Tesla’s value increases substantially.

It’s a win-win structure, according to supporters: Musk gets rewarded only if the company — and shareholders — benefit.

But if the plan fails? It could trigger uncertainty around Musk’s future at Tesla, especially as he continues expanding his portfolio of ambitious ventures across AI, social media, and space.

Bottom Line

Elon Musk is seeking the largest pay package ever proposed, not for a raise in the traditional sense, but for a larger stake in his own company — and more say over its direction. He insists it’s necessary to safeguard Tesla’s mission, while critics argue it’s an overreach.

The outcome of the shareholder vote — and the potential court rulings that follow — will not just shape Musk’s personal fortune. It may determine the leadership, strategy, and independence of one of the world’s most influential companies for years to come.

As always with Elon Musk, the stakes are high. And so is the headline.

News

My Mom Cut Me Out Of My Father’s Will, Saying I’d Abandoned The Family For My Career. I Walked Away And Didn’t Look Back. Years Later, Her Perfect Life Fell Apart, And She Ended Up In A Hospital Bed Alone…

The dining room had always made me feel like an intruder. Everything about it was designed to remind you that…

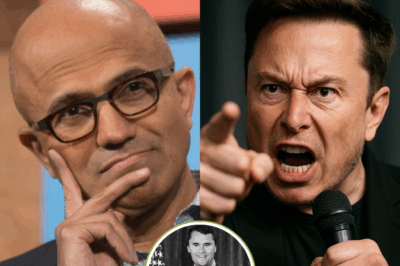

ELON MUSK ACCUSES MICROSOFT EMPLOYEES OF “CELEBRATING” CHARLIE KIRK’S MURDER — DEMANDS EXPLANATION FROM SATYA NADELLA 💥🧨 After several alleged posts from Activision Blizzard employees appeared to mock Charlie Kirk’s assassination, Elon Musk took to X and unleashed a firestorm. Calling the behavior “disgusting” and “vile,” Musk directly tagged Microsoft CEO Satya Nadella, demanding answers and accountability. “What kind of culture is being fostered at Microsoft?” he wrote. The posts have since disappeared, and Microsoft has stayed silent — but Musk’s comments, and the support they sparked from conservative users, are pushing this into full-blown public controversy. Is this about employee accountability — or a larger war over political speech in tech? 👇

Elon Musk’s high-profile criticism reignites debate over free speech, political violence, and tech industry culture after controversial online posts following…

“EXPLAIN THIS NOW.” — ELON MUSK TORCHES MICROSOFT AFTER ACTIVISION EMPLOYEES ACCUSED OF MOCKING CHARLIE KIRK’S DEATH 💻⚠️ Elon Musk didn’t hold back. After posts surfaced on X allegedly showing Activision Blizzard employees mocking Charlie Kirk’s assassination, the Tesla and X CEO called them “vile fanatics” and demanded answers from Microsoft CEO Satya Nadella. “This is a toxic culture,” Musk wrote. “This isn’t free speech — this is celebrating political violence.” The original posts are gone, no names confirmed, and Microsoft has said nothing publicly — but that silence is only fueling more backlash. Is this about content moderation? Corporate values? Or something deeper Musk is trying to spotlight? 👇

Elon Musk’s high-profile criticism reignites debate over free speech, political violence, and tech industry culture after controversial online posts following…

“SATURDAYS WERE HIS DAY” — ERIKA’S NEW POST IS BREAKING HEARTS AND MAKING PEOPLE ASK WHAT SHE’S HOLDING BACK 😢📸 For most people, weekends come and go. But Erika just revealed why Saturdays will never be the same — and it has nothing to do with the calendar. In a quiet Instagram post, she shared one of the last photos she took of Charlie, taken during a hike that now feels frozen in time. There’s something about the look on his face — calm, alive, completely unbothered by everything except the moment. She didn’t explain much. She didn’t have to. The image speaks for itself. But it also leaves a question hanging: What was the real story behind that day?

Erika’s story isn’t about headlines or viral posts—it’s about quiet heartbreak, deep resilience, and what it means to carry love…

ERIKA KIRK SHARES A QUIET PHOTO THAT SAYS MORE THAN WORDS EVER COULD 💔🕊️ Most people just saw a beautiful hike. But to Erika, the photo she posted yesterday captured one of the last Saturdays that still felt whole. No caption explaining it all — just an image of Charlie, standing in the sun, completely at peace. It’s the kind of picture that makes you stop and stare a little longer, wondering: What was he thinking in that moment? Why did Erika choose this photo, this Saturday, now? And what does it feel like to keep reliving a day you can’t get back? The image is still up. But the silence around it is louder than ever.

Erika’s story isn’t about headlines or viral posts—it’s about quiet heartbreak, deep resilience, and what it means to carry love…

I Gave a Gift from the Heart — and Got a Hard Lesson in Family Boundaries

The Birthday Gift That Exposed Everything: A Grandmother’s Cruel Lesson in Consequences Chapter 1: The Golden Child and the Forgotten…

End of content

No more pages to load