🔥 Interest Rate FURY

Trump’s anger stems from Powell’s refusal to cut interest rates aggressively, despite soaring inflation anxiety. Trump claims prolonged high rates are “crushing the American Dream.” On Truth Social, he raged that Powell’s “termination cannot come fast enough” and later admitted drafting a termination letter—only to later retract, claiming he has “no intention” of firing him… for now .

🏛️ Can He Really Do It?

Legally, terminating a Fed Chair isn’t simple. While Trump, who appointed Powell in 2017, can technically remove him “for cause”—inefficiency, neglect, or malfeasance—the definition remains nebulous. Recent SP Court decisions have limited presidential power in this area, and Powell is insulated unless serious misconduct is proven .

BREAKING: Trump Threatens to FIRE Fed Chair Powell Over Interest Rates—Markets Brace for Chaos!

💥 Wall Street Says NO WAY

Wall Street titans are freaking out. Major banks like JPMorgan and Goldman Sachs warn that firing Powell could trigger economic disaster—spiking inflation, crashing markets, and crippling the dollar . Investors are already jittery; market moves suggest a peak in Treasury yields and a possible 6% slide in the dollar if Trump follows through .

🏗️ Renovation Fallout or Rate Revenge?

Trump is weaponizing the Fed’s $2.5 billion renovation of its D.C. headquarters—calling the project “absurdly expensive” and “symbolic of Powell’s waste.” He insists cost overruns give him “cause” to sack Powell. Powell fired back, calling for an inspector general review—and insists the funds went to necessary repairs, not gilded luxuries .

⚖️ Political Chess or Economic Sabotage?

Despite feints, Trump later backed down, stating he won’t fire Powell—unless fraud is proven . Republican senators—including Thom Tillis and John Kennedy—warn that threatening the Fed is a dangerous game, risking politicization and undermining U.S. credibility .

Still, insiders say Trump might delay until Powell’s term ends in 2026, installing a more dovish chair, hoping to pressure the Fed indirectly by using renovation oversight as leverage .

📉 Market Mood: Nervous & Volatile

Markets despise uncertainty—and Trump’s verbal jabs have markets spooked. Analysts warn his feud could unleash bond market mayhem, inflation spikes, and legacy economic damage . With inflation still near 2.7%, even a modest tweak in rate policy could rattle sectors from mortgages to stocks.

🧭 The Final Word: Trump vs. The Fed—Battle or Bluff?

Trump’s latest salvo reflects deep frustration that Powell isn’t delivering rate relief fast enough. But firing the Fed Chair is a high-stakes gamble, legally dubious and economically perilous. While Trump may wait until 2026 for a replacement, his public pressure alone is rattling markets and shaking institutional faith.

This showdown is more than politics—it’s a direct test of whether financial governance can withstand executive threats. The entire economy is watching.

👉 Stay tuned—because if Trump moves next, the U.S. financial landscape may never be the same.

News

CH1 “MAGA Civil War: How Trump and Marjorie Taylor Greene Went From Allies to Arch-Enemies in the Epstein Files Showdown”

In a stunning rupture that has stunned the conservative political world, Donald Trump, once the ardent backer of fiery Georgia…

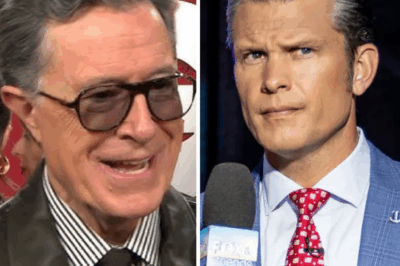

Stephen Colbert Didn’t Hold Back—His Latest Monologue Torches Pete Hegseth With a Scathing, Unfiltered Takedown That Set Late Night (and the Internet) on Fire

Colbert Ignites a Firestorm: The “Five-Star Douche” Blast at Hegseth Sends Shockwaves Through Late-Night TV and Social Media The…

CH1 “ALLERGIC TO HONESTY?” — Rachel Maddow Obliterates Karoline Leavitt on Live TV with a Single Cold-Blooded Line That Froze the Studio and Set the Internet on Fire!…

Television has seen countless political brawls — shouting matches, overly rehearsed talking points, and debates engineered more for spectacle…

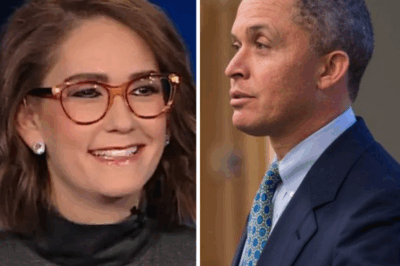

CH1 Fox News Rumor Shockwave: Will Harold Ford Jr. Replace Jessica Tarlov on The Five? Fans Brace for a Major Prime-Time Shakeup

Fox News is riding high after The Five pulled an incredible 3.851 million viewers in Q2 2025, making it…

CH1 “Alt-Country Icon’s Sudden Exit: The Unraveling Final Chapter of Todd Snider”

When you examine the arc of Todd Snider’s career—from scrappy troubadour to revered Americana storyteller—the news of his passing on…

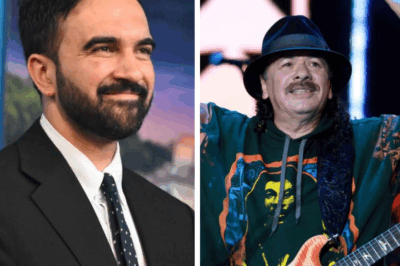

CH1 BREAKING NEWS: Carlos Santana Pulls the Plug on Every 2026 NYC Show — “SORRY NEW YORK, I DON’T PLAY FOR COMMIES”

New York City woke up Friday to shock, confusion, and at least three million double-takes after legendary guitarist Carlos…

End of content

No more pages to load