In a move that immediately stirred debate across financial, political, and sports communities, former U.S. President Donald Trump has issued a full pardon to British billionaire Joe Lewis, the 88-year-old investor best known for his long association with Tottenham Hotspur Football Club. The decision effectively wipes clean Lewis’s 2024 conviction in a high-profile insider trading case—one that led to a $5 million fine, three years of probation, and a rare courtroom apology from a man who had once stood atop the global business world.

The pardon closes a dramatic chapter in the life of one of Britain’s wealthiest and most influential investors. It also raises questions about presidential authority, the nature of forgiveness in the legal system, and how a billionaire once accused of enriching friends and employees with privileged financial information came to be relieved of his sentence.

While Lewis had avoided prison time due to age, health concerns, and a negotiated plea, the criminal conviction remained a major mark on his legacy—until now.

This article unpacks what happened, why it matters, and what this surprising pardon means for the future of the Lewis business empire.

From London to Wall Street: The Rise of Joe Lewis

Before becoming a household name due to legal troubles, Joe Lewis was known for a remarkable climb through the worlds of investment, hospitality, and sports. Born in east London, he built a global portfolio spanning real estate, energy, restaurants, entertainment, and more.

His connection to sports made him famous beyond business circles. As the longtime controlling figure behind Tottenham Hotspur, he oversaw the construction of one of the world’s most advanced stadiums and transformed the club into a consistent Premier League presence. Years before charges were filed, he had already transferred majority ownership to a family trust, ensuring the club would be steered by the next generation.

Even after stepping back from direct involvement, Lewis remained a central figure in British business, with deep investments in companies including Mitchells & Butlers—one of the largest operators of pubs and restaurants in the UK.

But in 2023, his name appeared in headlines for a very different reason.

The Insider Trading Case That Changed Everything

In 2023, prosecutors in New York unveiled a detailed 29-page legal brief outlining Lewis’s alleged role in sharing confidential financial information with associates. The document described an insider trading scheme involving:

Personal assistants

Pilots operating his private jet

Business partners

Close personal acquaintances

The allegations included claims that Lewis intentionally passed along privileged information about upcoming financial announcements, allowing recipients to make profitable stock trades.

Prosecutors characterized the scheme as “brazen,” arguing that Lewis used confidential insights as favors to enrich those around him.

Initially, Lewis’s legal team pushed back, arguing that federal officials had committed an “egregious mistake” in charging him with multiple counts of securities fraud and conspiracy. But as negotiations progressed and the possibility of a lengthy court battle loomed, Lewis eventually changed his plea.

In early 2024, he formally acknowledged wrongdoing.

A Guilty Plea, a Rare Apology, and a Non-Custodial Sentence

At his sentencing, Lewis addressed the court directly.

“I made a terrible mistake. I broke the law. I am ashamed, sorry, and I hold myself accountable.”

The admission was striking—the billionaire’s first public acknowledgment of responsibility. The judge presiding over the case, Jessica Clarke, weighed his age, health, philanthropic activity, and the circumstances of the offenses before deciding against prison time.

Instead, Lewis received:

A $5 million personal fine

Three years of probation

A $44 million fine issued to Broad Bay, one of his companies

These penalties were significant but far from the maximum possible under federal law. Because the sentence involved no incarceration, Lewis retained the ability to request a future pardon should circumstances arise.

And they did.

The Pardon: What It Covers and What It Doesn’t

The Daily Telegraph first reported that Donald Trump intended to pardon Lewis. Hours later, the decision was confirmed.

The pardon fully absolves Lewis of the conviction. However, according to reports, the financial penalties will not be refunded—neither to Lewis personally, nor to Broad Bay.

The White House stated that Lewis sought the pardon to regain the freedom to travel, receive medical care in the U.S., and spend time with his grandchildren and great-grandchildren. Given his age and health concerns, these factors reportedly played a significant role in the request.

Shortly after the announcement, Lewis released a statement expressing relief.

“I am pleased all of this is now behind me, and I can enjoy retirement and watch as my family and extended family continue to build our businesses based on the quality and pursuit of excellence that has become our trademark.”

A source close to the family noted that Lewis’s legacy extends far beyond the insider trading case, highlighting decades of entrepreneurship and international investment.

The Family Takes the Reins: Tottenham and the Global Empire

It’s important to remember that Lewis had already passed day-to-day control of Tottenham Hotspur to a trust in 2022—well before his conviction. Today, the club is overseen by:

Vivienne Lewis, his daughter

Charles Lewis, his son

Nick Beucher, Vivienne’s son-in-law

The club itself was never implicated in Lewis’s case, but the legal turmoil did cast a temporary shadow over the family’s oversight.

Beyond football, the Lewis business network spans multiple continents. His assets include stakes in hospitality chains, property developments, energy companies, and entertainment ventures. With the conviction now removed, the family’s business strategy may gain renewed stability—particularly in markets sensitive to reputational risk.

Why This Pardon Matters

The decision carries implications far beyond the personal life of Joe Lewis.

1. Signals About Presidential Pardons

This episode highlights the significant discretion held by presidents in granting clemency. Pardons can be issued for reasons ranging from humanitarian concerns to perceived injustices—or, as in this case, arguments about age, health, and family hardship.

2. Impacts on Financial Regulation

High-profile pardons involving financial crimes often prompt questions about accountability. Critics may argue that absolving a billionaire sends the wrong message. Supporters may say the conviction itself—and the large fines—provided sufficient consequence.

3. International Attention

Because Lewis is a major figure in both UK business and global investment, the pardon has drawn attention from international media and analysts. Questions about cross-border legal cooperation and high-profile financial cases often emerge in such situations.

4. Legacy and Influence

Removing the conviction reshapes how Lewis’s long career will be remembered. Instead of ending under the cloud of a criminal record, his legacy will now be viewed through a more complicated—but less legally damaging—lens.

A Billionaire’s Story, Rewritten Again

Joe Lewis has lived a life marked by enormous business success, global influence, and high-profile accomplishments in sports and hospitality. The insider trading case forced a painful and public reckoning. The pardon now allows him to close that chapter for good.

Whether the public sees this moment as justice, mercy, or controversy will depend on personal perspective. But one thing is undeniable: the pardon ensures that Lewis’s story will continue to be told—not simply as a tale of legal missteps, but as one of the most dramatic turnarounds in the recent intersection of business, politics, and global finance.

News

Politico Names Gavin Newsom the Democratic Party’s Early ‘Frontrunner’ for 2028

The 2028 presidential election is still years away, but one name is rapidly rising above the rest in Democratic circles:…

Cynthia Erivo Responds After Unruly Fan Lunges at Ariana Grande on the ‘Wicked: For Good’ Red Carpet

Cynthia Erivo is finally speaking out about the frightening moment that shook the “Wicked: For Good” premiere in Singapore —…

2025 U.S. Government Shutdown: The Longest in History Ends After 43 Days

After 43 long days, the United States has emerged from the longest federal government shutdown ever recorded, a grinding standoff…

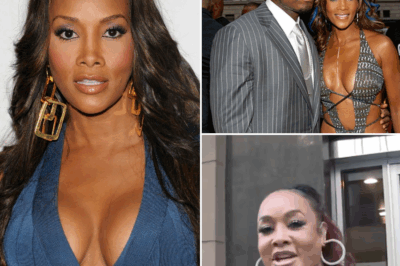

Vivica Fox: Go Ahead and Date 50 Cent … Just Be Careful!!!

Vivica A. Fox has never been shy, but her latest viral moment—an off-the-cuff warning about dating rappers—spun so wildly online…

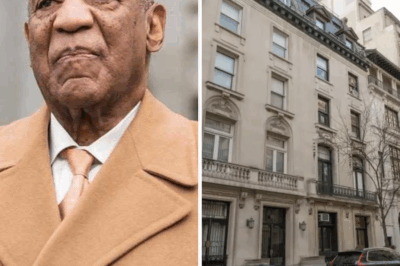

Bill Cosby Sells Debt‑Ridden NYC Townhouse for a Massive Profit, Avoiding Foreclosure

Bill Cosby’s long-owned Upper East Side mansion—a towering seven-story limestone showpiece built at the height of New York’s Gilded Age—has…

Trump Administration Challenges California Law That Bars ICE Agents From Using Masks to Conceal Their Identities

A fierce constitutional clash erupted this week as the Trump administration filed a federal lawsuit contesting California’s new laws that…

End of content

No more pages to load