The Minnesota social services fraud scandal — now estimated at nearly $1 billion in stolen taxpayer funds — has exploded into one of the most consequential welfare investigations in modern U.S. history. What began as whispers inside Minnesota’s Department of Human Services (DHS) has expanded into a sprawling federal probe involving the Justice Department, Treasury, FBI, IRS, and Congress. The scandal has rocked Gov. Tim Walz’s administration, placed Rep. Ilhan Omar under renewed scrutiny, and triggered political and law-enforcement shockwaves as far as Maine.

At its center: a network of schemes linked largely to nonprofits and vendors within Minnesota’s Somali-American community, exploiting federal programs created or expanded during the COVID-19 emergency. While the vast majority of Somali Minnesotans had no involvement, investigators say the programs’ structure — rapid rollout, weak guardrails, and a reliance on third-party self-reporting — allowed bad actors to siphon federal dollars with unprecedented scale and sophistication.

The Core: How Nearly $1 Billion Was Stolen

Federal prosecutors describe three major fraud clusters:

1. Feeding Our Future (Child Nutrition Program Fraud)

More than 80 defendants charged.

Fake meal sites reported feeding “thousands” of children daily.

Estimated $250+ million stolen.

Money laundered through shell companies, fake invoices, and overseas transfers.

Some defendants lived lavishly — luxury cars, overseas real estate, jewelry — all paid for with pandemic nutrition funds.

2. Housing Stabilization Services (Medicaid-linked Fraud)

Intended to help homeless or disabled Minnesotans.

Program paid out over $100 million in a single year, despite being budgeted at $2.6 million.

Fraud included billing for nonexistent visits or services that never occurred.

3. Early Intensive Developmental and Behavioral Intervention (Autism Therapy Fraud)

Program ballooned from $3 million (2018) to nearly $400 million (2023).

Investigators found fabricated diagnoses, fabricated therapy sessions, and cash kickbacks to parents.

Collectively, federal officials now estimate losses approaching $1 billion across COVID-era DHS programs.

Treasury: Funds May Have Been Sent Overseas

The U.S. Treasury Department has opened a parallel financial investigation into whether part of the stolen Minnesota aid was transferred abroad — including to Somalia and the Middle East — with possible ties to al-Shabaab, the al-Qaeda affiliate destabilizing East Africa.

Treasury Secretary Scott Bessent said investigators are “tracking money flows that should never have left Minnesota.”

He accused political leaders of minimizing the scandal.

Whistleblowers: “We Were Threatened for Raising Red Flags.”

By late 2025, an anonymous collective claiming to represent more than 480 DHS employees began posting allegations online:

Repeated warnings to superiors — including Walz’s office — were ignored.

Staff who flagged irregular billing were reprimanded, isolated, or threatened.

Internal culture fostered fear rather than oversight.

Federal investigators are now examining these retaliation claims as part of the broader inquiry.

Omar’s Role: Scrutiny Over Donations and Public Messaging

Rep. Ilhan Omar has condemned the fraud as “reprehensible,” but federal officials have noted:

Individuals charged in the fraud schemes donated to Omar, Gov. Walz, and AG Keith Ellison.

Omar’s office says all such contributions were returned years ago.

Treasury Secretary Bessent accused her of “gaslighting the American people” by downplaying the scandal’s severity and dismissing concerns about terrorism-financing risks.

Omar denies wrongdoing and says the real failure lies with federal agencies for not catching international transfers sooner.

Governor Walz Under Fire

Gov. Tim Walz has faced blistering criticism over:

Delayed state action.

Weak oversight structures.

DHS commissioner decisions under his leadership.

Failure to fire any senior officials connected to improper oversight.

House Oversight Chairman James Comer has accused Walz of being “fully aware” of fraud indicators years earlier.

Walz maintains Minnesota was targeted by opportunistic criminals because its social programs are generous.

Beyond Minnesota: A Disturbing Parallel in Maine

In 2025, a whistleblower in Maine came forward with allegations that a Somali-owned mental-health services company, Gateway Community Services, fraudulently billed Medicaid for:

Services not performed.

Staff visits that never occurred.

Manipulated electronic tracking records.

The company received $28.8 million in Medicaid reimbursements over five years.

The owner, Abdullahi Ali — reportedly involved in Somali regional politics — has been accused of mismanagement and potential overseas political funding.

No federal charges have yet been filed, but the case is under review and being directly compared to Minnesota’s system-wide failures.

Is This a National Trend?

The Minnesota and Maine scandals involve similar patterns:

Third-party nonprofits.

Weak auditing mechanisms.

COVID-era rule changes.

Concentrated immigrant communities with complex transnational financial networks.

However, there is no formal indication that Somali-American-led fraud is widespread nationwide. Other states have seen isolated cases, but none approach Minnesota’s scale.

Federal Stakes: Debt, Funding, and Public Trust

The U.S. national debt exceeds $38 trillion, and welfare fraud undermines both federal solvency and public confidence. Improper payments across Medicaid, SNAP, and related programs already cost $100–$200 billion annually, according to GAO reports.

Minnesota’s scandal is now the defining case study in how emergency federal programs — combined with inadequate state oversight — can spiral into systemic criminal operations.

More indictments are coming, and Congress is preparing for hearings that could reshape federal-state funding relationships for welfare programs.

News

Jim Carrey Revives His Most Stinging Trump Takedown: “He Didn’t Make America Great Again — He Just Turned Back the Odometer”

Actor and comedian Jim Carrey is once again lighting up social media with a blistering rebuke of President Donald Trump,…

Alina Habba Resigns as U.S. Attorney for New Jersey After Court Battle Over Her Appointment

NEW JERSEY — After months of legal turmoil and mounting judicial backlash, Alina Habba has stepped down as Acting U.S….

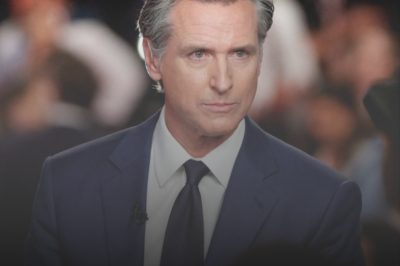

A Balanced Look at Governor Gavin Newsom’s Record: Ambition, Achievements, and a California Divided

California Governor Gavin Newsom has long been framed as one of America’s most charismatic political figures—an image reinforced by his…

Candace Owens: How a Once-Obscure Commentator Became the Most Dangerous Woman on the Internet

By the time Candace Owens began publicly insisting that French president Emmanuel Macron and his wife Brigitte were part of…

ABC Extends Jimmy Kimmel’s Contract Through 2027 After Turbulent Saga Over Charlie Kirk Comments

ABC has renewed Jimmy Kimmel’s contract for another year—extending the late-night host’s tenure through May 2027—following what insiders describe as…

Greg Abbott Makes Major Announcement About Turning Point USA in Texas, Warns Schools Against Blocking ‘Club America’

Texas Gov. Greg Abbott on Monday issued his strongest endorsement yet of Turning Point USA’s (TPUSA) high school network —…

End of content

No more pages to load