A high-stakes corporate takeover battle is unfolding behind closed doors in Washington and Hollywood — one involving senior White House officials, billionaire tech titan Larry Ellison, major television networks, and a proposed shake-up at CNN that could reshape the American media landscape.

According to multiple people familiar with the matter, Ellison — the Oracle co-founder and largest shareholder of Paramount — has recently held informal conversations that touched on potential changes to CNN’s anchor lineup should Paramount succeed in acquiring Warner Bros Discovery, parent company of CNN, HBO, and Warner Bros Studios.

The reported discussions included speculative talk about replacing certain CNN hosts whom former President Donald Trump has publicly criticized, as well as floating the idea of integrating CBS programs such as 60 Minutes into CNN’s schedule.

None of the conversations were official, and Ellison does not currently hold an executive role at Paramount, which is run day-to-day by his son, David Ellison. But the mere existence of such discussions — during a period when the White House reportedly views the Paramount-Skydance bid as its preferred option — underscores how entangled politics, media power, and corporate strategy have become in the nation’s capital.

Spokespeople for the White House, CNN, Oracle, and Paramount declined to comment on the reported conversations, which individuals familiar with the matter emphasized were informal.

Still, the implications are enormous. The potential sale of Warner Bros Discovery — the owner of CNN, HBO, Warner Bros Studios, DC Films, and Discovery networks — would be one of the largest media transactions of the decade, touching on everything from competition law to journalistic independence.

And the White House is watching closely.

White House Preference: Paramount Seen as the Bid That “Could Clear Regulators”

According to people briefed on internal discussions, senior White House officials have privately expressed the view that Paramount-Skydance would be the “cleanest” acquirer of Warner Bros Discovery because it is less likely to trigger a prolonged regulatory battle.

Paramount has repeatedly pitched itself as the bidder least likely to run into major antitrust barriers — especially compared to other interested giants such as Comcast or Netflix, each of which could face intense scrutiny for expanding their already massive media footprints.

A former Justice Department antitrust official from Trump’s second term argued that the Paramount bid would “not pose serious antitrust issues,” calling the competition concerns “minimal” compared with other alternatives.

Similarly, FCC Chair Brendan Carr stated earlier this year that he would be “very surprised” if an FCC review were triggered at all, saying the transaction would likely not fall under the commission’s standard jurisdiction.

Privately, Paramount executives have told advisers that receiving even tacit signals of interest from federal officials could help position them as the leading contender. For the Ellisons — both the billionaire father and the media-executive son — Warner Bros Discovery represents not just a business expansion but a chance to reshape the global entertainment market.

The Reported Ellison Call: CNN Programming, Anchor Changes, and a Proposal That Caught Washington’s Attention

According to multiple people familiar with the matter, Ellison spoke informally with a White House contact about various hypothetical programming changes that might follow a Paramount acquisition.

Those conversations, as described by these individuals, touched on several topics:

Speculative anchor changes at CNN, including hosts whom Trump has openly criticized

Brainstorming potential replacements for high-profile talent

The concept of airing CBS properties — including 60 Minutes — on CNN to expand the network’s prestige programming slate

Sources familiar with the call said it was not a formal negotiation, nor was it framed as a promise or guarantee. Instead, it resembled broad, hypothetical media-strategy chatter — albeit with potentially enormous implications given CNN’s role as one of the nation’s most influential news outlets.

Still, the content of the call has “animated the White House,” the sources said, generating intense internal interest in how a Paramount-run CNN might differ from the current brand.

No official statements have been issued by the White House or CNN.

Why This Matters: CNN’s Political Standing and Trump’s Long History of Criticism

CNN’s coverage of Trump — during both his presidency and his time as a political figure — has been a frequent target of the former president’s public ire. Trump has repeatedly singled out hosts, including Erin Burnett and Brianna Keilar, who have moderated or reported on some of the most contentious news cycles of the past decade.

In this context, any speculation — even hypothetical — about significant CNN personnel changes would naturally raise political eyebrows.

However, without official confirmation, it’s unclear whether the reported discussions reflect actual policy preferences, strategic brainstorming by Ellison, or simple “big picture” media talk.

One individual familiar with the matter described the conversation as “the sort of speculative, informal exchange that happens constantly in media-political circles — especially when a major acquisition is on the table.”

Still, the timing raises questions, as Paramount is working aggressively to present its bid as the most desirable option for political and regulatory stakeholders.

Trump’s History With Paramount: A Settlement and a Strategic Relationship

In the background of this debate is an unusual connection: Paramount previously paid a $16 million settlement to Trump relating to a 60 Minutes segment featuring then-candidate Kamala Harris, which Trump deemed unfair.

The settlement, people close to the matter say, strengthened the Ellisons’ relationship with the former president — and may now be helping Paramount present itself as a bid that would face less resistance from the White House.

Multiple current and former consultants now working in federal government roles also previously contracted with Oracle, where Larry Ellison serves as executive chairman. That network of relationships has drawn attention as the Paramount-Skydance bid gathers momentum.

Why Warner Bros Discovery Is Up for Sale — And Why Everyone Wants It

The target of this corporate feeding frenzy, Warner Bros Discovery, is one of the most valuable media conglomerates in the world. Its assets include:

Warner Bros Studios

DC Entertainment

CNN

HBO and HBO Max

Discovery Channel properties

Turner Networks

In October, the company announced it was open to offers after months of financial strain, restructuring, and strategic reevaluation.

Paramount is expected to submit a full bid before the November 20 deadline for non-binding offers, alongside competitors such as:

Netflix (interested in Warner’s library to feed streaming growth)

Comcast/NBCUniversal (eager to consolidate scale and compete with Netflix)

However, Comcast faces possible political friction — Trump has repeatedly accused NBC News and MSNBC of treating him unfairly.

If Paramount were to acquire Warner Bros Discovery outright, it would reshape the American media ecosystem:

Two major film studios under one umbrella

CNN and CBS potentially integrated

HBO positioned to expand globally through Paramount’s platforms

Major consolidation in the streaming wars

It would also ignite intense debate about political influence, media independence, and whether entertainment companies should have any line of communication about news programming with government officials.

Regulatory Questions: Will the DOJ or FCC Step In?

Former officials have suggested that, despite the massive scale of the proposed acquisition, antitrust concerns appear limited.

“This won’t pose serious antitrust issues,” one former DOJ attorney said.

Brendan Carr of the FCC has publicly echoed similar sentiments.

Still, the political optics of the White House favoring a particular bidder — especially one in reported conversation with officials about hypothetical programming shifts — could spark congressional scrutiny.

For now, the Justice Department’s antitrust division remains the primary regulator likely to review the bid.

Ellison’s Motives: A Tech Billionaire With a Growing Media Ambition

Larry Ellison has long cultivated influence in Silicon Valley, Washington, and corporate media circles.

His son, David Ellison, runs Skydance Media — the studio behind Top Gun: Maverick, Mission: Impossible – Fallout, and a suite of streaming deals with Apple and Amazon. Their expanding media empire positions them to be major players in the future of content production and distribution.

Acquiring Warner Bros Discovery would propel the Ellisons into the top tier of global entertainment powerbrokers.

And CNN, in particular, is an asset that carries enormous cultural weight — and immediate political relevance.

The Bottom Line: A Media Deal With National Consequences

If Paramount succeeds, it will not just be another corporate merger. It will be:

a transformation of the streaming landscape

a consolidation of two storied film studios

a reshuffling of cable news power

a test of political influence in media acquisitions

The reported conversations between Ellison and a White House contact illustrate how closely politics and media strategy are intertwined — especially when a network as influential as CNN is involved.

For now, the players remain silent. The White House will not comment. CNN stays quiet. Paramount has filed no official statements about its programming intentions. And Warner Bros Discovery continues entertaining bids.

But the deadline is approaching — and with it, a potential seismic shift in how American media is owned, produced, and controlled.

The fate of CNN, HBO, Warner Bros Studios, and one of the country’s largest newsrooms could be decided in the coming weeks.

And in a twist worthy of a Hollywood script, the outcome may depend as much on whispered conversations in Washington as on the financial spreadsheets in Los Angeles.

News

Fugees Rapper Pras Michel Sentenced to 14 Years in Prison for Illegal Donations to Obama Campaign

The rise and fall of Prakazrel “Pras” Michel has the sweep of a Hollywood tragedy — global intrigue, political money,…

Socialist Mayor-Elect Explains Why She Accepted Financial Help From Her Parents at Age 43

Seattle’s newly elected mayor, Katie Wilson, has spent the last two weeks doing something few politicians ever attempt — turning…

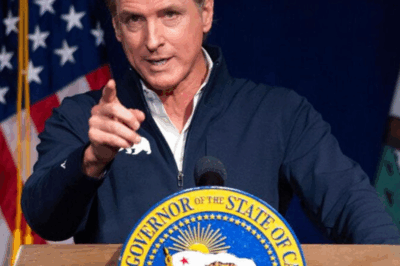

DOJ Sues Gov. Newsom Over California Program Offering College Tuition Benefits to Undocumented Immigrants

The political collision between Governor Gavin Newsom and President Donald Trump reached its most dramatic stage yet this week as…

Zohran Mamdani Shocks the Establishment: How a 34-Year-Old Democratic Socialist Became NYC’s Most Disruptive Mayor-Elect Ever

New York City hasn’t seen a political earthquake quite like this in decades. At just 34 years old, Zohran Kwame…

Rylan Clark: From X Factor Camp to Candid TV Trailblazer

Ross Richard “Rylan” Clark is not built for the background. At 37, the towering Essex-born presenter with the trademark smile,…

Joe Biden At 83

As Joseph R. Biden Jr. marks his 83rd birthday on November 20, 2025, the nation once again finds itself taking…

End of content

No more pages to load