One of New York City’s most infamous real estate figures is once again at the center of a sweeping legal and financial storm.

Steven Croman, the landlord whose aggressive business tactics and 2017 mortgage-fraud conviction made him one of the city’s most scrutinized property owners, is now facing nearly $170 million in alleged loan defaults and the possibility of foreclosure on more than 35 Manhattan buildings, according to a wave of recent lawsuits.

The new filings, lodged in Manhattan Supreme Court over the past several weeks, paint the picture of a sprawling and deteriorating financial situation. The lender now seeking relief, Orange Owner LLC, alleges that Croman has failed to make loan payments for months across a large portion of his real estate portfolio.

If the allegations prove true, Croman—who once controlled around 140 buildings citywide—may be headed toward the most significant financial collapse of his career.

Neither Croman nor attorneys for Orange Owner have commented publicly.

But court documents describe a cascade of alleged delinquencies, rapidly compounding arrears, and a widening foreclosure threat that could reshape ownership of dozens of high-rent Manhattan properties.

From Bank Merger to Legal Blitz: How $168 Million in Loan Defaults Came to Light

The root of the current legal barrage began with loans originally issued by New York Community Bank, later folded into Flagstar Bank after a 2022 merger. In late 2024, the loans were reassigned to Orange Owner LLC, which within weeks filed 20 separate lawsuits alleging widespread payment failures.

According to the filings:

Croman is allegedly in default on at least $168 million in outstanding real estate loans

The defaults involve roughly three dozen Manhattan properties

The alleged missed payments stretch across multiple months

Some buildings carry arrears exceeding $1 million as late fees continue to compound

The lawsuits seek repayment of full mortgage balances—not just arrears—as lenders often demand once a loan enters formal default.

Court records also show additional previously reported defaults totaling more than $45 million, suggesting that Croman’s financial troubles may be broader than what the newest filings capture.

A History That Haunts: Croman’s 2017 Conviction and the Origins of His Reputation

The financial pressure now engulfing Croman arrives years after a high-profile criminal case that permanently reshaped his public image.

In 2016, following an extensive investigation, New York prosecutors accused Croman of filing fraudulent paperwork to obtain tens of millions of dollars in loans. He ultimately pleaded guilty to mortgage fraud in 2017 and served one year on Rikers Island.

At the time, then–New York Attorney General Eric Schneiderman referred to him as the “Bernie Madoff of landlords”, citing both the scale of his real estate holdings and the nature of the allegations.

The 2016 prosecution also included accusations—separate from the fraud case—that Croman hired a former police officer to pressure rent-stabilized tenants into leaving their units, allowing him to raise rents. Those allegations were part of a civil investigation, not a criminal plea, and remain part of the public record surrounding his business practices during that era.

Though Croman resumed operations after serving time, the new lawsuits suggest that financial strain within his portfolio may now be reaching a critical breaking point.

Inside the New Defaults: Millions Owed Across Manhattan

The lawsuits list a series of properties across prized Manhattan neighborhoods—Gramercy, Kips Bay, the West Village, the Lower East Side, and more—each carrying substantial loan balances.

Below is a closer look at some of the biggest filings.

1. Kips Bay — 209 E. 25th St.

Loan total: $12.4 million

Alleged arrears: $493,845 (as of October), more than half from late fees

Building details: 44-unit rental, apartments fetching up to $5,500 per month

According to Orange Owner’s notice of default, Croman allegedly missed payments for a two-month period on this property, triggering penalties and legal action.

2. Gramercy Park — 346 E. 18th St.

Loan total: $10.37 million

Alleged arrears: $362,332

Rent range: $7,500 to nearly $10,000 per month

This lawsuit alleges Croman fell behind in October, again with late fees driving a significant portion of the arrears.

3. West Village — Christopher Street Properties

Loan total: $21.4 million (pair of buildings)

Alleged arrears: $1.2 million (as of late October)

Missed payments since: August

This is the largest single alleged default to date. The lawsuit states that Croman has not made payments for months and that arrears continued to climb rapidly.

4. Additional Foreclosures Reported Earlier in the Year

Separate reporting from Crain’s New York Business earlier this year identified other foreclosure actions totaling at least $45.5 million in alleged defaults.

When combined with the newest lawsuits, the potential at-risk total rises to well above $200 million.

Why So Many Properties at Once? Experts Cite a Changing Market

Real estate attorneys and analysts not connected to the case note that large, multi-building defaults can reflect several underlying factors:

• Rising interest rates

Many property owners who refinanced aggressively between 2015 and 2020 are now facing dramatically higher loan costs.

• Shifts in New York City rental dynamics

Neighborhoods that once saw near-perfect occupancy now face volatility, especially in smaller walk-up buildings.

• Ongoing legal costs

Landlords with past legal challenges sometimes face debt burdens or restrictions that reduce liquidity.

• Building maintenance obligations

Older buildings—many in Croman’s portfolio—often require expensive upgrades to meet NYC compliance standards.

Whether these issues affect Croman directly is unclear, but analysts say the sheer volume of simultaneous defaults suggests a systemic cash-flow strain.

What Happens Next? A Potential Multi-Property Foreclosure Wave

If Orange Owner prevails in court, the consequences could be transformative:

Dozens of valuable Manhattan buildings may enter foreclosure

Croman could lose major portions of his operating empire

Tenants in affected buildings could see management changes

The city’s real estate market could see dozens of distressed assets hit the market at once

Multi-building foreclosures of this scale are rare, even in New York’s highly leveraged property environment.

A key question is whether Orange Owner seeks:

Full foreclosure,

Restructuring agreements, or

A negotiated settlement involving partial repayment.

The lender has not commented publicly, and the lawsuits provide only the initial claims—not the lender’s long-term strategy.

Croman Has Not Yet Filed Responses

At this time, Croman has not formally responded to the claims in court, and neither his legal team nor public representatives returned requests for comment.

In past legal battles, he has sometimes pursued settlements, contested allegations vigorously, or restructured debt—meaning a range of outcomes is still possible.

Tenant Advocates Watching Closely

Croman’s properties have long drawn attention from tenant rights groups, particularly in the East Village, West Village, and Lower Manhattan.

Advocates say they are watching the new foreclosure developments for potential tenant impacts:

Could receivers be appointed?

Will new owners take over buildings?

Are renters at risk of instability?

State law provides significant protections, but major ownership changes often create uncertainty.

Tenant attorneys say they expect courts to appoint property managers if buildings become distressed, ensuring essential services remain in place.

A Once-Rising Landlord Now Facing His Largest Challenge

In the early 2000s and 2010s, Steven Croman expanded aggressively, acquiring properties in some of Manhattan’s most desirable ZIP codes. His holdings made him a major figure in the small multifamily building market—a niche with steady cashflow and long-term value.

But with a 2017 felony conviction, years of legal scrutiny, and now nearly $170 million in alleged defaults, Croman’s real estate empire appears under its greatest pressure yet.

If the lawsuits proceed to foreclosure, it could mark the dismantling of one of the city’s most controversial property portfolios.

The Bigger Picture: What This Means for NYC’s Real Estate Market

Major foreclosures like these can have ripple effects across New York City real estate:

Distressed assets may come to market at reduced sale prices

Investors may move quickly to acquire properties in neighborhoods like the West Village and Gramercy

Banks and private lenders may re-evaluate exposure to multifamily landlords

Rent-regulated units may see management transitions

In an era of tighter credit, higher rates, and increased scrutiny of landlords, Croman’s case may be an early indicator of broader trends.

A High-Stakes Reckoning for One of NYC’s Most Watched Landlords

Steven Croman’s legal and financial saga has entered a new chapter—one that may ultimately reshape the ownership of dozens of Manhattan buildings and bring an end to one of the city’s most controversial landlord empires.

With 20 lawsuits, nearly $170 million in alleged defaults, and the real possibility of large-scale foreclosure, the stakes could not be higher.

The court process is still in its early phases.

Croman has not responded.

Lenders are seeking full repayment.

And tenants across Manhattan are waiting to see what comes next.

For now, the legal filings offer a rare, sweeping look at the financial turmoil behind the scenes of a once-expansive real estate portfolio.

What happens next will reverberate from the courts of Manhattan to the hallways of dozens of apartment buildings — and potentially reshape New York’s small-building real estate landscape for years to come.

News

Larry Ellison Discussed Ousting CNN Hosts With the White House During Takeover Bid Talks

A high-stakes corporate takeover battle is unfolding behind closed doors in Washington and Hollywood — one involving senior White House…

Fugees Rapper Pras Michel Sentenced to 14 Years in Prison for Illegal Donations to Obama Campaign

The rise and fall of Prakazrel “Pras” Michel has the sweep of a Hollywood tragedy — global intrigue, political money,…

Socialist Mayor-Elect Explains Why She Accepted Financial Help From Her Parents at Age 43

Seattle’s newly elected mayor, Katie Wilson, has spent the last two weeks doing something few politicians ever attempt — turning…

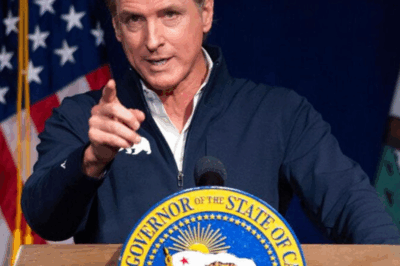

DOJ Sues Gov. Newsom Over California Program Offering College Tuition Benefits to Undocumented Immigrants

The political collision between Governor Gavin Newsom and President Donald Trump reached its most dramatic stage yet this week as…

Zohran Mamdani Shocks the Establishment: How a 34-Year-Old Democratic Socialist Became NYC’s Most Disruptive Mayor-Elect Ever

New York City hasn’t seen a political earthquake quite like this in decades. At just 34 years old, Zohran Kwame…

Rylan Clark: From X Factor Camp to Candid TV Trailblazer

Ross Richard “Rylan” Clark is not built for the background. At 37, the towering Essex-born presenter with the trademark smile,…

End of content

No more pages to load