Visa, MasterCard reach settlement agreement in swipe fee lawsuit

Your local café could raise surcharges on or stop accepting premium cards.

By Molly Liebergall,

A legal dispute older than the iPhone might finally be wrapping up: Visa and Mastercard reached a settlement agreement with a group of businesses that accused them of charging unfairly high swipe fees 20 years ago, the card networks announced yesterday.

Currently, merchants typically pay credit card companies between 2% and 2.5% per customer transaction. An “honor all cards” rule among Visa and Mastercard networks also requires businesses to accept all or none of their plastic. But under the new proposed deal:

Visa and Mastercard would lower their swipe fees by an average of 0.1% for five years, saving businesses an estimated $30+ billion.

Businesses would get more surcharge flexibility and could broadly choose to accept certain cards by category—commercial, standard, and premium.

What this means for you: Potentially lower credit card surcharges that some merchants, especially small businesses, started tacking onto your receipt in recent years. Unfortunately for rewards chasers, your local café could also raise surcharges on or stop accepting premium cards (e.g., Chase Sapphire Reserve), which usually charge higher swipe fees to help subsidize their fancy perks. But premium cardholders dominate consumer spending, so it would be risky for businesses to refuse that category altogether.

Looking ahead…the deal needs approval from a judge who rejected a previous settlement attempt last year, calling its proposed 0.07% fee reduction “paltry.”—ML

News

Canadian dad dies trying to rescue 5-year-old daughter who was swept into ocean by large California waves

A courageous Canadian father died attempting to save his 5-year-old daughter who was swept out to sea during California’s catastrophic…

USDA chief says ‘everyone’ will have to reapply for SNAP benefits after claiming rampant fraud

The head of the US Department of Agriculture said the Trump administration is planning to have “everyone” receiving SNAP benefits reapply after…

‘Mr. Peter, can I call you my dad?’: Single man adopts 11-year-old from foster care after biological and adoptive family abandon him

“Anthony entered foster care at the young age of 2 and was adopted when he was 4 years old. He was the…

Tony-winning ‘Gilmore Girls’ actress Elizabeth Franz dead at 84

Elizabeth Franz, the Tony Award-winning actress who played inn owner Mia in “Gilmore Girls,” has died. She was 84. Franz…

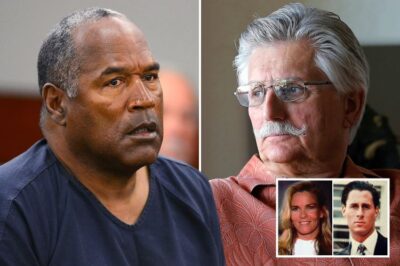

OJ Simpson estate signs off on $58M for Ron Goldman’s father, decades after shocking double murder

Fred Goldman may be closer to finally receiving payment from OJ Simpson’s estate nearly three decades after winning a wrongful…

Christina Ricci claims Megyn Kelly is a ‘danger to children’ for downplaying Jeffrey Epstein’s crimes

Christina Ricci lashed out at Megyn Kelly for downplaying Jeffrey Epstein’s crimes. Taking to her Instagram Stories, the “Yellowjackets” star…

End of content

No more pages to load