When my daughter Margaret looked me dead in the eye at Thanksgiving dinner and said,

“Stop begging for money. It’s embarrassing,” something inside me cracked like ice on a frozen lake.

I smiled sweetly, picked up my phone, and texted my bank:

Cancel all authorized user cards immediately.

By morning, all three of my ungrateful children would discover that their financial safety net had vanished faster than their respect for me.

Let me back up.

I’m Eleanor Walsh, 62 years old, retired high school English teacher from Ohio.

And this is how I ended up declaring war on my own children over mashed potatoes and stuffing.

It started when I asked my daughter Margaret to pay back the $15,000 I’d loaned her eight months ago for her kitchen renovation.

Not demanded—asked. Politely, like you’d ask someone to pass the salt.

“Mom, we talked about this,” she said, not even looking up from her plate. “That was a gift, remember?”

A gift.

Apparently, the $15,000 for her kitchen was a gift, just like the $8,000 for David’s car and the $12,000 for Sarah’s credit card debt were gifts too.

Funny how I didn’t remember agreeing to give away $35,000 of my retirement savings.

“Actually, honey, I have the text messages where you promised to pay it back by Christmas,” I said, keeping my tone light.

“I thought we could discuss a payment plan.”

That’s when Margaret dropped her fork and gave me that look—the one that says I’m being unreasonable for expecting my own money back.

“Mom, seriously, we’re having Thanksgiving dinner. This is so inappropriate.”

David, my 34-year-old son, decided to chime in.

“Yeah, Mom. It’s kind of tacky to talk about money at family dinner.”

Tacky.

Apparently, it was tacky for me to mention the money they’d borrowed—but not tacky for them to spend it on luxury vacations and designer handbags while I stretched my pension to make ends meet.

Then Sarah twisted the knife deeper.

“We all contribute to this family in different ways. Just because you have savings doesn’t mean you should keep track of every penny like some loan shark.”

My savings. My retirement. Four decades of grading papers until midnight.

But it was Margaret’s next words that sealed their fate.

“Honestly, Mom, stop begging for money. It’s embarrassing. We’re your children, not your debtors.”

The table went silent. Even the grandkids stopped talking.

I let those words hang in the air before I stood up.

“You’re absolutely right, sweetheart,” I said. “I should stop begging.”

Then I sent the text to my bank. And another to my credit card company. And one more to my investment adviser.

All those authorized user cards—gone.

The joint checking account I’d opened with David for his business—frozen.

The credit line I’d co-signed for Sarah’s apartment—terminated.

I finished my meal while they chattered about Black Friday sales, completely unaware of the financial earthquake I’d just triggered.

Their cards would start declining in six hours when the systems updated overnight.

I slept better that night than I had in years.

It had started small, after my husband Tom died three years ago.

I was grieving, lonely, and when Margaret called crying—“Mom, we need help”—how could I say no?

They had kids, a mortgage, and Mark’s hours were cut. I wrote that first check for $3,000 without hesitation.

But then came another call. And another.

Before long, I was covering car repairs, moving costs, credit card bills.

They always promised to pay me back “once things stabilized.”

Funny how things never stabilized.

By early 2024, I was practically funding their entire lifestyle.

Margaret’s kitchen renovation. David’s “investment opportunity” (a cryptocurrency scam).

Sarah’s endless credit card debt.

I was eating canned soup and clipping coupons while they were ordering DoorDash and upgrading iPhones.

And still they saw me as rich.

The Thanksgiving dinner was simply the last straw.

At 6:47 a.m. on Black Friday, my phone started ringing.

Margaret first. Then David. Then Sarah.

Their frantic texts came one after another:

Mom, my card was declined at Target.

Mom, something’s wrong with the bank.

Mom, answer your phone. This is urgent.

I poured myself coffee, did my crossword, and ignored them all.

By 10:15, Margaret was on my porch, pacing like a caged animal.

“Mom, what did you do?” she demanded the moment I opened the door.

“Had breakfast. Eggs were perfect,” I said. “Would you like some coffee?”

“This isn’t funny. Our cards aren’t working. Mark had to leave his cart at the store. The kids are asking why Daddy can’t buy Christmas presents.”

“Have you tried paying with your own money?”

She blinked. “What do you mean our own money? You gave us access to those accounts!”

“I gave you emergency access,” I said evenly. “Not unlimited access to fund your lifestyle while ignoring your debts.”

Her face went pale. “Those were gifts, Mom.”

“I never said any such thing,” I replied. “I have every text where you promised repayment. Would you like me to read them?”

She started crying. “We can’t afford groceries! The kids need clothes!”

“Funny,” I said, “you could afford that weekend trip to Chicago last month.”

I opened the door wider. “You can leave now. When you’re ready to talk about repayment, call me. Until then, stay off my property.”

“You can’t be serious.”

“Try me.”

She left in tears.

That night, I took a long bath with expensive salts I’d been saving.

Then I painted my nails burgundy and ordered Thai takeout.

It felt like Christmas morning and my birthday rolled into one.

The family “intervention” was David’s idea.

“Mom, we need to sit down and work this out like adults,” he said over the phone.

“This has gone too far.”

I agreed to meet them—out of curiosity more than anything.

At Margaret’s house, they’d assembled like a tribunal.

Margaret, her husband Mark, David and his girlfriend, Sarah and her boyfriend.

Margaret led with a concerned frown. “Mom, we think you’re having some kind of emotional breakdown.”

An emotional breakdown. Because asking for my own money back was madness, apparently.

“We’re worried about you,” David said. “You’ve always been so understanding.”

“Understanding?” I asked. “Yes, I was very understanding while you picked my bank account clean.”

Sarah tried her gentle voice. “Mom, we know Dad’s death was hard on you. Maybe you should talk to someone—a therapist, maybe?”

Ah yes, the grief card. Because clearly, financial boundaries meant I was unwell.

I smiled. “You think I’m having a breakdown because I want you to honor your debts?”

“Those weren’t debts,” Margaret said. “Family helps family.”

“When exactly,” I asked, “will that family help go both ways? Because I’ve been waiting three years.”

Mark tried to step in. “Mrs. Walsh, maybe we can work out a payment plan.”

“You mean like the one Margaret agreed to last spring? The one where she was going to pay $500 a month starting in June? That means she owes me $3,000 already.”

The room fell silent.

I turned to David. “Or maybe the plan where you’d pay me from your tax refund eighteen months ago? Did you forget to file, or just forget about me?”

He turned red.

“And Sarah,” I said, “how’s that promotion you celebrated on Instagram with a shopping spree? Ten months ago, wasn’t it?”

She looked like she might cry.

I stood, smoothing my dress. “Here’s my plan: you have 60 days to repay every penny. We’ll agree on a written schedule, or I consult a lawyer.”

“You can’t sue your own children,” Margaret whispered.

I smiled. “Watch me.”

Within two weeks, I discovered Sarah had been using my credit card for over a year—gas, restaurants, online shopping.

I confronted her.

“You’ve been stealing from me,” I said.

“It wasn’t stealing! I needed things!”

“Using someone’s card without permission is fraud,” I said. “Even if you’re my daughter.”

She burst into tears. “You wouldn’t press charges!”

“Try me.”

By March, my attorney had sent formal demand letters to all three.

When they ignored them, I filed through her office.

At mediation, their lawyer insisted the money was “gifts.”

My lawyer slid a folder of texts, emails, and bank records across the table.

Silence.

By the end of the meeting, they’d agreed to repay $55,400 in total—loans and unauthorized charges—plus interest, with three-year wage garnishments.

As we left, Margaret whispered, “Mom, can’t we fix this as a family?”

I looked at her and said quietly, “We stopped being a family the day you decided I was just your ATM.”

That night, I took myself out to dinner. Lobster. Wine. Dessert. The works.

Respect, I realized, isn’t free. Sometimes you have to bill for it.

Months later, I uncovered one last secret: a letter from Tom, my late husband.

He’d written it before he died, afraid he was developing dementia.

He explained that the business account David had tried to access was meant as a surprise for me—$34,000 for our anniversary trip to Ireland.

He ended with this line:

Don’t let the children take advantage of your kindness the way I sometimes did. You have my permission to be selfish for once.

I cried for him that day. Then I deposited the money.

Two years later, my children have paid their debts in full.

They’ve grown up—finally.

When Margaret called to invite me to dinner, I said yes.

It wasn’t a tearful reunion, but it was… respectful.

Sarah showed photos of her new apartment—paid for entirely by herself.

David talked about how paying me back taught him what money really costs.

Margaret hugged me at my car. “I learned that my mother is tougher than I ever gave her credit for.”

And I smiled. Because she was right.

The woman who once bent over backward to keep the peace was gone.

Now there’s just Eleanor Walsh—retired teacher, independent woman, bridge champion, and the proud owner of her peace and dignity.

My children taught me something they never intended to:

Love without respect is worthless.

And sometimes the most loving thing you can do for your family is to stop letting them walk all over you.

News

ch1 My estranged father refused to dance with me at my wedding, humiliating me to appease his new wife. He sat back down, smug, certain he held all the power…

I stopped expecting much from my father the day he walked out when I was ten. But when he offered…

ch1 A student missed his exam after rescuing an unconscious man — but when he found out who the man was, his whole future shifted overnight.

Oliver, a final-year university student, was racing through the rain-slick streets of Manchester on his bicycle. Today was the day…

ch1 The university student who missed his exam after saving an unconscious company chairman — and how his life changed forever…

Oliver, a final-year university student, was racing through the rain-slick streets of Manchester on his bicycle. Today was the day…

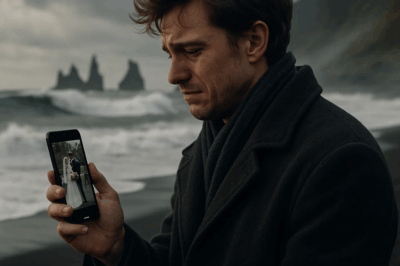

ch1 Family Excluded Me From My Sister’s Wedding — So I Escaped to Iceland and Watched Her Big Day Fall…

The Empty Chair I found out I wasn’t invited to my sister’s wedding while holding a paper plate of macaroni…

ch1 They Hid Me From The Wedding Because They Were Ashamed Of Me. Mom Said: ‘You’ll Ruin The Photos.’…

They hid me from the wedding because they were ashamed of me.Mom said, “You’ll ruin the photos.”Dad added, “Some people…

ch1 I Kept Quiet About My Fortune at My Daughter’s Wedding — Until She Called Me ‘Broke’ in Her Speech…

At my daughter’s wedding, I stood with a microphone in hand, the crystal glasses still clinking from the last toast….

End of content

No more pages to load