Midnight Balance

The Night Shift

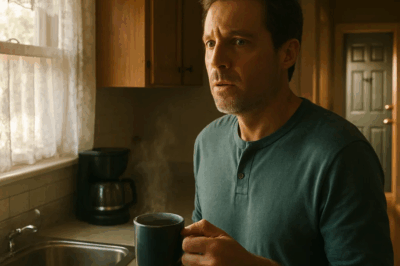

The lobby of the downtown hotel always smelled faintly of lemon polish and lost dreams. At two in the morning, the marble floors gleamed like a mirror, and the only movement came from the slow sweep of the janitor’s mop and the steady ticking of the clock behind the reception desk.

That was my world — the hours when everyone else slept.

My name is Lamia, twenty-four and a half I’m based out of San Francisco Bay area.

Each night I balanced the ledgers for people who would never know my name — travelers who slept above me in clean shee

I earned $30.81 an hour,

Sometimes I wondered if I chose this

The computer beeped softly. A guest’s folio didn’t balance. Room 809.

Inherited Debt

When the lobby lights dimmed,

That was the day I learned I was already in coll.

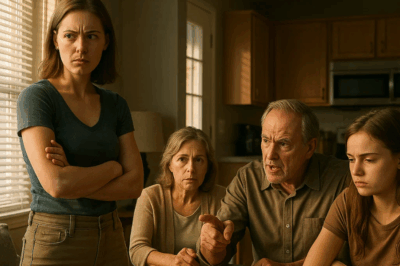

A dental bill I never knew existed, $1,200 for work I didn’t authorize. My father’s signatur

I remember standing in the bank, palms sweating as the teller explained that my credit was “unfavorable.” I was eighteen and already financially bruised. I negotiated with the debt collectors like a child bargaining for bedtime, offering half, pleading ignorance. They didn’t c

Mom said it was “good practice.” Build credit, shOpen a small credit card. Buy little things and p

I didn’t know yet that adults could also be cruel.

For a while, I believed I was learning how to be responsible. Then the pandemic hit, and the idea of responsibility twisted into survival.

My father broke his spine in a car accident just before everything shut down. Hospitals overflowed; lawyers delayed; nothing moved but bills. He couldn’t work, or so he said, though even before that he rarely did. The lights went out one evening, and when I woke up in the dark, I found him digging through my purse. My debit card glinted in his hand.

“Don’t make Mom angry,” he whispered. “You don’t want her upset, do you?”

It was a strange kind of inheritance — not land or jewelry, but shame.

I paid the electric bill. Then the phone bill. Then his cigarettes.

By twenty I had three maxed-out cards, no savings, and a permanent tremor that came whenever I heard the word due.

The Car

When you grow up in chaos, you start believing that every disaster is a test of loyalty. That was the logic when my mother offered me a deal: my grandfather’s old Subaru, cheap, if I let my father use it for doctor’s appointments.

I saved every penny from my stimulus checks — $3,500 — and bought it. For an hour, it was mine.

Then it wasn’t.

Oil changes. Brake pads. Registration fees. He used the car daily; I paid for everything. I didn’t know what a lien was, but my mother did. She put one on the title — to protect me, she said. It protected no one.

By the time I realized the trap, the car had become a weapon.

Whenever I protested, he would take it and vanish for days.

“You wouldn’t want to strand your father,” Mom would say.

I thought about moving out. At eighteen, I even packed a bag.

Then came the talk: If people are trying to separate you from your family, they’re trying to control you.

I stayed. Because guilt, when practiced long enough, becomes gravity.

The Crash

Freedom came by accident — literally.

The Subaru died on a wet stretch of highway one night, and I walked away with a bruised knee and an excuse to leave. My grandfather helped me buy another car. I owed him five thousand dollars, another chain, but a longer leash.

I moved in with friends, got a job at a hotel, learned how to breathe again.

For the first time in years, my paychecks stayed in my own account. I learned what a budget spreadsheet was and cried the first time I saw the word savings on my banking app.

Then the guilt followed, as it always did. My mother called.

“What are you paying your grandfather each month?”

“Do you even care what he thinks of you?”

“He says you’re ungrateful.”

Maybe he never said that. Maybe she did. But it worked.

I paid more than I could afford. I skipped meals.

I bought cheap frozen rice bowls and told myself this was independence.

The Spiral

Debt is quiet. It doesn’t crash in like a storm; it seeps under the door.

A small Uber ride here, a $10 meal there. A moment of loneliness turned into a $30 quesadilla delivered cold at 2 a.m. because I didn’t have the strength to cook.

By twenty-two I was living alone, technically free, but the ghosts of old habits haunted every purchase. I’d open my banking app and feel my chest tighten — not from the numbers themselves, but from the memories attached to them.

Each statement was a diary of weakness: Wendy’s, Taco Bell, Uber Eats, Starbucks, Ticketmaster.

Little acts of comfort that built a fortress of debt.

Sometimes, when therapy got too heavy, I’d drive to the coast and sit by the water, watching the fog roll in. I’d think about what my therapist called financial trauma — the idea that money wasn’t just currency, it wa

Audits

At work I was promoted to Lead Night Auditor — a title that felt like a joke. I could balance a hotel’s books down to the cent but couldn’t balance my own life.

Each night, I watched transactions clear and thought about all the invisible people behind them — the ones ordering wine because they couldn’t sleep, the ones booking flights to escape, the ones pretending to be fine. Maybe they were all like me, managing chaos with a calculator.

One night, while reconciling accounts, I realized something absurdly simple: if I could track the mistakes of hundreds of strangers, I could track my own.

I built a spreadsheet, color-coded and meticulous.

Green for bills, red for mistakes, yellow for the small joys I refused to give up — a candle, a latte, a new notebook.

For the first time, I saw the truth laid bare.

My income was real, but so were my wounds.

Therapy

“You’ve been living in survival mode,” my therapist said one afternoon, her voice soft.

“It’s hard to make rational financial choices when your nervous system thinks every moment is danger.”

I nodded. She was right.

Every time I paid off a card, I felt the same thrill as closing a wound — only to open another.

We talked about coping mechanisms. About guilt. About learning to spend money on purpose rather than panic.

The next time I wanted to order food, I made a rule: I had to wait ten minutes. If I still wanted it after ten minutes, fine. Usually, I didn’t.

It wasn’t much, but it was a start.

Standing Up

The real test came when my father called again.

He wanted me to delay graduation so I could lend him money.

For the first time, I said no.

He shouted, then begged, then laughed.

“You think you’re better than me now?”

I hung up. My hands were shaking, but not from fear. From adrenaline.

That night, I cried in my car until dawn, then went to work and balanced the books as usual. The numbers lined up perfectly. So did my resolve.

Building a Future

I started saving — not for emergencies, but for freedom.

Three thousand dollars, my goal. Enough to cover rent, food, and car insurance if life collapsed again.

I stopped using my credit cards. Cut them up. Deleted the apps.

When the urge to spend hit, I opened my savings account instead and stared at the balance like it was a sunrise.

It grew slowly — a few hundred at a time — but it grew.

Control felt like oxygen.

At work, my coworkers joked that I was the most organized person they knew.

If only they knew how chaos had trained me.

Leaving

In May next year, I’ll graduate with a degree in Hospitality Management. My student loans are nearly gone; the braces are paid down; my emergency fund is alive.

I tell everyone I plan to work abroad — maybe Japan, maybe Europe — “just for a while.”

The truth is, I don’t plan on coming back.

My family doesn’t know that part.

They still think of me as the daughter who will always return to fix what they break.

They don’t know I’m building a life where no one can reach into my purse again.

Sometimes I imagine the day I board the plane.

The airport’s fluorescent hum. The weight of my backpack. The final vibration of my phone when I turn it to airplane mode.

Freedom sounds like silence.

The Ledger

It’s almost dawn again. The last guest checks out, the printer hums, and the sky over the Bay turns gray.

I log into the final report:

Balance: $0.00.

Everything reconciled. Everything closed.

For a moment I just sit there, hands on the keyboard, staring at those numbers.

Zero debt. Zero balance. Zero chaos.

Maybe one day, that’ll be my life too.

Maybe one day, I’ll wake up and realize I’ve finally audited myself into peace.

Until then, I’ll keep counting.

Not because I have to — but because, for the first time, I can.

Epilogue

When people ask what I do for a living, I tell them I’m a night auditor.

They smile politely, imagining spreadsheets and receipts.

But that’s not the truth.

I balance ghosts. I reconcile trauma. I count the quiet victories that never make it into the reports.

Every number is a story, and every story — mine included — is proof that you can climb out, inch by inch, from the debts you didn’t deserve.

You can pay back everything, except the time you lost.

And maybe, if you’re lucky, you learn that breaking even is its own kind of grace.

News

(CH1) My Mother Told Me I Couldn’t Afford Dad’s Birthday Dinner! Then The Staff Greeted Me As The Owner…

The blood rushed to my fingertips, making them tingle as I held the key card to my own hotel, watching…

(CH1) That morning began like any other… until the knock…

An Unexpected Visitor Alters Everything Three measured knocks came softly at the door—not rushed, not hesitant. Yet, the sound carried…

(CH1) At Thanksgiving, My Sister Discovered I Had $12 Million And My Family Demanded…

I’m Sarah, 38 years old, and I need to get this off my chest. Do you know those family dynamics…

(CH1) Parents Demanded I Sell My House To Pay Off My Sister’s $150000 Debt After They Cut Me Out 5 Yrs…

Hi, I’m Sarah. Today I’m going to read you the story of Celeste, which is titled like this: “My parents…

(CH1) Brother Asked Me to Sing at His Wedding as a Gift, Even Though I Haven’t Sung in Ten Years. He…

My brother asked me to sing at his wedding as a gift even though I haven’t sung in 10 years….

(CH1) HUMBLE SERVANT TAKES HER BABY DAUGHTER TO WORK… AND THE MILLIONAIRE’S GESTURE LEFT EVERYONE IN SHOCK

A humble cleaning lady, with no one to leave her little girl with, decided to bring her daughter to work—but…

End of content

No more pages to load