My Parents Tried Forcing Me Out Of “Their Investment Property” — So I Called The Bank

The smell of chlorine from my morning swim was still on my skin when I saw a stranger drilling into my front door lock.

My mother was inside taking photos while my father supervised from the porch. He told me they were renting the place out because the market was up. When he said the investors gave permission, not me, I did the only thing that would make them freeze.

I pulled out my phone and called the bank.

My name is Harper Thompson, and I’m thirty‑four years old. I’ve lived in Aurora, Colorado, for four years, building a life that felt solitary but secure.

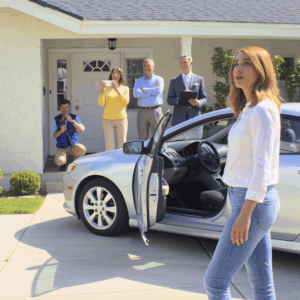

Or at least I thought it was secure until I pulled into my driveway at ten in the morning on a Tuesday.

The sky was that piercing high‑altitude blue that makes everything look sharper than it really is, but the scene in front of my front door didn’t need any extra clarity to look like a nightmare.

I turned off the ignition of my SUV. The silence of the engine cutting out was instantly replaced by a high‑pitched mechanical whining sound. It was the sound of metal eating into metal.

I stepped out, my gym bag heavy on my shoulder, the smell of chlorine from my morning laps still clinging to my skin and hair. My muscles were tired in that good, heavy way you feel after swimming two miles, but the adrenaline spike that hit me the second my boots touched the pavement erased all of that fatigue.

There was a man kneeling at my front door. He wore a utility vest and held a heavy‑duty power drill, and he was systematically destroying my deadbolt.

That was shocking enough. But it was the audience standing three feet behind him that made my stomach drop through the concrete.

My mother, Marjorie Whitman, was holding her phone up, panning it slowly across the front porch and the entryway as if she were filming a segment for a lifestyle channel. She was wearing her Sunday church blazer, the beige one with the gold buttons. On a Tuesday morning.

Next to her stood my father, Dale. He had his arms crossed over his chest, his posture rigid and authoritative, nodding at the man with the drill like a foreman inspecting a construction site.

And there was a third person, a man I didn’t recognize. He looked slippery—the kind of man who wore a suit that was slightly too shiny and a smile that didn’t reach his eyes. He was holding a clipboard and tapping a pen against his chin, watching my mother film with an approving nod.

I slammed my car door. The sound cracked through the suburban quiet like a gunshot.

The drilling stopped. The man in the vest looked over his shoulder. My parents turned.

“Stop,” I said.

It wasn’t a scream. It was a command, low and vibrating in my chest.

“What do you think you are doing?”

My father didn’t look guilty. That was the first thing that chilled me. A normal person caught breaking into a house would look terrified.

Dale Whitman just looked annoyed, like I was a delivery driver interrupting an important meeting. He checked his watch—a gold timepiece he’d bought when he retired—and frowned at me.

“You’re early,” he said.

Not hello. Not surprise. Just a criticism of my timing.

“I live here,” I said, walking up the driveway, ignoring the stranger in the shiny suit to stare directly at my father. “I come and go as I please. Why is there a man drilling a hole in my front door?”

“Standard maintenance, Harper,” my father said, his voice smooth, carrying that paternal tone he used to use when I was twelve and asked why I couldn’t go to a sleepover. “We’re upgrading the security. The old locks were flimsy.”

“The old locks were fine,” I said. “And I have keys to them. I do not have a key to whatever this guy is installing.”

“We’ll give you a copy for the transition period,” my mother chimed in. She lowered her phone, but didn’t put it away. She offered me a bright, strained smile.

“Oh, Harper, look at you. Your hair is wet. You’ll catch a cold.”

“Mom, stop,” I snapped.

I looked at the man with the drill. He was standing up now, looking between me and my father, sensing the tension.

“Who hired you?” I asked.

“I did,” the man in the shiny suit said.

He stepped forward, extending a hand that I absolutely did not shake.

“Gavin Holt, property consultant. Your parents have retained my firm to maximize the potential of their asset. We’re just doing some prep work for the listing photos.”

I felt the blood drain from my face.

“Listing photos,” I repeated.

“For the rental market,” Gavin said, his voice oily and confident. “The Aurora market is hot right now. Vacancy rates are under three percent. We need to get this unit on the market by the first of the month to capture the incoming transfer season.”

I looked at my father.

“You’re renting my house out?”

“We are renting the investment property out,” my father corrected.

He uncrossed his arms and placed his hands on his hips, full manager mode.

“Market conditions are optimal. Harper, we’ve been discussing this with Gavin for weeks. It makes no sense to have a three‑bedroom asset generating zero yield just because you want to rattle around in it alone.”

“I am not rattling around,” I said, my voice rising. “I live here. I bought this house. It is my home.”

“It is a family investment,” my father said, waving his hand dismissively. “We helped you with the down payment. We co‑signed. That makes it a partnership. And in this partnership, the majority vote says it’s time to liquidate the residency and pivot to income generation.”

I stared at him. The sheer audacity was so massive it was hard to comprehend. It wasn’t just greed. It was a complete rewriting of reality.

He wasn’t asking. He wasn’t suggesting. He was standing on my porch destroying my locks and telling me I was being pushed out of my own life because the market was good.

“No,” I said.

My father blinked.

“Excuse me?”

“No,” I repeated. “Get off my porch. Send the locksmith away. Tell this consultant to get in his car and drive until he hits Kansas.”

My father’s face darkened. The benevolent patriarch mask slipped, revealing the anger underneath.

“You do not give orders here,” he snapped. “Harper, you’re the occupant. We are the owners. Gavin explained the structure to us. Equitable interest means we control the disposition of the asset.”

“I don’t care what Gavin explained,” I said, shooting a glare at the consultant, who was now smirking slightly as he scribbled something on his clipboard. “I care about whose name is on the deed.”

The locksmith cleared his throat. He was a big guy holding the heavy drill like a shield. He looked uncomfortable.

“Look, folks,” he said, his voice gravelly. “I charge by the hour, but I don’t do domestic disputes. Who is the homeowner here? I need the owner to authorize the new key code.”

“I am,” my father and I said at the exact same time.

The air on the porch seemed to crackle.

“I am the senior investor,” my father said, stepping forward, using his physical size to try and dominate the space. He reached into the leather satchel my mother was holding and pulled out a thick sheaf of papers. “I have the documentation right here.”

He thrust a stack of paper toward the locksmith.

I glanced at it. It was a photocopy of a photocopy. It looked like the original closing documents from four years ago, but highlighted in yellow marker with sticky notes plastered all over the margins.

“See here,” my father said, pointing a thick finger at a line on the bottom of a page. “Dale Whitman, co‑signer. That is my signature. And here—” he flipped to another page “—financial guarantor. That gives me executive rights over the property management.”

The locksmith squinted at the paper. It was a mess of legalese, and to a layman, it probably looked impressive. He looked at my father, then at the suit‑wearing consultant, who was nodding vigorously.

“Mr. Whitman is the primary financial backer,” Gavin added smoothly. “Under Colorado equitable statutes, he has full right of access and modification.”

The locksmith looked convinced. He hefted his drill again.

“All right, as long as you got the paperwork. Look, miss,” he said, turning to me, his expression softening with pity. “Maybe you guys should sort this out inside. I just need twenty minutes to finish the deadbolt.”

My mother touched my arm.

“Come inside, Harper. We can pack your things. Gavin found a lovely efficiency apartment near the airport. It’s much more suitable for a single woman.”

Pack my things. An efficiency apartment. They hadn’t just planned to change the locks. They had planned to erase me.

I pulled my arm away from my mother like she’d burned me.

I didn’t scream. I didn’t cry. A cold calm washed over me—the kind of calm I used in my job as a compliance officer when I caught someone trying to bypass federal regulations.

“Wait,” I said to the locksmith.

“Miss, please,” he sighed.

“You want to see who owns this house?” I asked. “You want to know who actually pays for the roof you’re standing under?”

“I just need to know who signs the check,” the locksmith said.

“Fine,” I said. “Let’s follow the money.”

I pulled my phone out of my pocket. My hands were shaking, not from fear but from rage. But I forced my fingers to be steady as I unlocked the screen.

I opened my banking app. Face ID flashed and the numbers populated. I tapped on the transaction history. I filtered for “mortgage.”

I walked right up to the locksmith, ignoring my father, who was trying to block me, and shoved the screen in front of the locksmith’s face.

“Read that,” I said.

The locksmith squinted at the bright screen.

“Transfer… two thousand four hundred fifty dollars,” he read.

“And the date?” I asked.

“First of the month,” he said.

“And who is the sender?” I pressed.

“Harper Thompson,” he read aloud.

“Scroll down,” I commanded. “Read the one before that and the one before that.”

He scrolled.

“Harper Thompson. Harper Thompson. Harper Thompson.”

I took a step back.

“That is four years of mortgage payments. Every single cent paid by me, from my account, solely. I turned to my father. “Show him your receipt, Dad. Show him the transaction where you paid the mortgage this month or last month or any month in the last four years.”

My father’s face went red.

“That is irrelevant. The down payment is a gift letter—”

“I cut him off. “Remember? You signed a gift letter to the bank saying it was not a loan so I could qualify. You want me to pull that up too? Because it’s in my cloud storage.”

I turned back to the locksmith.

“These people are co‑signers. That means if I get hit by a bus and stop paying, the bank comes after them. It does not mean they own my house. It does not mean they can drill my locks, and it certainly does not mean they can push me out.”

The locksmith looked at the digital proof on my phone—crisp, undeniable, up‑to‑date banking records. Then he looked at the messy highlighter‑stained photocopies in my father’s hand. He looked at Gavin, who was suddenly very interested in the texture of the stucco wall and refusing to make eye contact.

The locksmith chuckled. It was a dry, humorless sound.

He reached down and unplugged his drill from the extension cord.

“Whoa,” the locksmith said. He began winding the cord around his arm. “I am out.”

“Wait,” my father barked. “We have a contract with you.”

“You misrepresented the job,” the locksmith said, tossing the drill into his tool bag with a heavy clank. “You said you were the owners and the tenant was vacating. You didn’t say the owner was standing right here showing me her mortgage receipts.”

“She is not the owner,” my mother shrilled, her voice cracking. “She is our daughter.”

“Lady, I don’t care if she’s your daughter or the President,” the locksmith said, hoisting his bag onto his shoulder. “I do not touch disputed property. Liability 101. If you want this lock changed, you bring me a court order. Until then, I am gone.”

He walked past me, and as he did, he tipped his chin at me.

“Sorry about the door, miss. The mechanism is damaged, but it’ll still lock from the inside with the deadbolt thumb turn. Just don’t lose your key.”

“Thank you,” I said.

We watched him walk to his white van, throw his gear in the back, and drive away.

The silence that followed was heavy and suffocating.

My father turned on me. The vein in his forehead was throbbing.

“What is wrong with you?” he hissed. “Do you have any idea how embarrassing that was? You treated us like criminals in front of a tradesman.”

“You were acting like criminals,” I said. “You were breaking and entering.”

“We are your parents,” my mother cried, clutching her phone like a talisman. “We are trying to secure your future. Gavin has a plan to generate three thousand a month in passive income. That money could go into a trust. It could help us retire. We are a family, Harper. Why are you so selfish?”

“Selfish?” I laughed, but there was no humor in it. “I’m selfish for living in the house I pay for?”

“You don’t understand finance,” Gavin interjected. He had recovered his composure now that the locksmith was gone. He stepped forward, flashing that used‑car‑salesman smile again.

“Harper—can I call you Harper? Look, emotion clouds judgment. Your parents are looking at the bigger picture. This property has appreciated forty percent. To let it sit as a single‑occupancy residence is financially irresponsible. We can leverage the equity—”

“Get off my driveway,” I said.

Gavin blinked.

“I’m just trying to mediate.”

“I’m not mediating with a trespasser,” I said. “If you’re not in your car in ten seconds, I’m calling the police. And unlike the bank, the police do not care about equitable interest. They care about who’s on the deed.”

Gavin looked at my father.

“Dale, perhaps we should regroup at the office. The environment here is hostile.”

“Go,” my father said to him, but his eyes were locked on mine, full of disappointment and rage. “We’ll handle her.”

Gavin nodded and scurried toward his car, a silver sedan parked at the curb.

“You have made a mistake, Harper,” my father said, his voice dropping to a menacing whisper. “You think that little banking app makes you big? You think you can cut us out? We built you.”

“You co‑signed a loan, Dad,” I said. “You didn’t build me, and you definitely do not own me.”

“We’ll see,” he said. “The bank listens to the people with the leverage, and we have more leverage than you think.”

He grabbed my mother’s arm.

“Come on, Marjorie. Let her cool off. She’ll realize how unreasonable she’s being when she sees the numbers.”

They marched down the driveway, creating a united front of indignation. My mother looked back once, her face twisted in a mix of sorrow and anger, as if I were the one who had betrayed them.

I stood on my porch, trembling slightly now that the adrenaline was fading. The morning sun felt too hot. The hole where the locksmith had started drilling was a jagged silver scar in the dark wood of my door.

I watched them get into their SUV. I watched Gavin get into his silver sedan, and that was when I saw it.

Gavin’s car was parked directly in front of my mailbox. The back seat was full of cardboard signs. Through the rear window, I could clearly read the top one.

It was professional, printed in bold red and white letters.

PRE‑LEASE TODAY. THREE BED, TWO BATH. AVAILABLE IMMEDIATELY. CONTACT GAVIN HOLT CONSULTING.

I felt a cold shiver go down my spine that had nothing to do with the chlorine from the pool.

Available immediately.

They hadn’t come here to ask. They hadn’t come here to discuss. They hadn’t even come here to warn me. They had come here to execute a plan that was already in motion.

They weren’t preparing to list it. They had already started marketing it. Somewhere out there, people were probably already looking at photos of my living room, thinking it was available.

My father’s words echoed in my head.

“The bank listens to the people with the leverage.”

I realized then that this wasn’t just a domestic dispute. They weren’t just overstepping boundaries. They were playing a game with rules I didn’t know, using paperwork I hadn’t seen.

I looked down at my phone. The banking app was still open.

“I made a mistake,” I whispered to the empty driveway. “No, Dad. You made the mistake.”

I didn’t go inside to pack. I didn’t go inside to cry.

I tapped the “Contact Us” button on the banking app. I pressed the icon for a phone call.

I wasn’t going to argue with my parents anymore. I wasn’t going to debate ethics with a consultant like Gavin Holt.

I was going to do the one thing that cuts through every lie, every delusion, and every family “understanding.”

I was going straight to the institution that actually held the deed.

I held the phone to my ear, listening to the ring, watching the dust settle on my driveway. My parents thought they were investors.

They were about to find out they were just liabilities.

I walked inside and locked the deadbolt. It was a futile gesture considering the lock was half destroyed, but the mechanical click gave me a sliver of psychological safety.

The house was silent. It was the kind of silence I used to crave—the silence I had fought tooth and nail to afford. But now it felt heavy. It felt like the air inside a courtroom before the judge walks in.

I went to the kitchen island and set my phone down on the granite countertop. I stared at the banking app, the screen dimming and then going black.

To understand why I did what I did next, you have to understand that this house was not just a collection of wood and drywall to me. It was the wreckage I had clung to after my life fell apart.

I was thirty years old when I signed the divorce papers. My ex‑husband had been charming, ambitious, and fundamentally incapable of telling the truth about our finances. By the time I extricated myself from that marriage, my credit score was a smoking crater, and my self‑esteem wasn’t much better.

I spent two years rebuilding. I lived in a studio apartment that smelled like boiled cabbage and listened to my neighbors argue through paper‑thin walls. I worked sixty‑hour weeks at North Bay Compliance Group, climbing from a junior auditor to a compliance manager. I saved every dollar that didn’t go to rent or basic sustenance. I stopped eating out. I stopped buying clothes. I became obsessed with stability.

Then came the year 2020.

The world went mad. Interest rates hit the floor, and I saw a chance to reclaim my dignity.

I found this house in Aurora. It was a three‑bedroom ranch‑style build from the eighties. Outdated but solid. The price was three hundred fifty thousand dollars. It was a stretch, but I could make the monthly payments.

The problem was the bank. Because my credit history still had bruises from my divorce and because the lending market was jittery during the pandemic, the underwriter balked. They wanted more assurance.

That was when my parents stepped in.

I remember the conversation vividly. We were sitting on their back patio in the United States, the late‑afternoon Colorado sun slanting across the yard. My father, Dale, had poured himself a scotch and looked at me with what I thought was pride. He said that family helps family. He said they had some liquidity from selling a rental property in Florida. They offered to give me twenty thousand dollars for the closing costs to lower the loan‑to‑value ratio. And more importantly, they offered to co‑sign the mortgage to get the approval across the finish line.

I hesitated. I remember asking my mother, Marjorie, if this would put any strain on them. She had squeezed my hand and told me that my happiness was their only investment.

We signed a gift letter. That’s a crucial piece of paper in American real estate. It is a legal affidavit stating that the money provided is a gift, not a loan, and that there is no expectation of repayment.

My father signed it. My mother signed it. We sent it to the lender.

For four years, I honored that trust. I paid every single mortgage payment. I paid the property taxes. I paid the insurance. I paid for the new roof when a hailstorm shredded the shingles last summer. I paid for the water heater when it flooded the basement. My parents never put another dime into the property after that initial closing day.

But people change. Or maybe circumstances just strip away the polite veneer and reveal who people really are.

My parents retired eighteen months ago. The market downturn hit their portfolio harder than they expected. Inflation ate into their fixed income. The comfortable American retirement they’d bragged about started to look a little thin around the edges.

I noticed the change in our Sunday dinners. The conversations shifted from golf and gardening to complaints about gas prices and the cost of healthcare.

Then came the comments about my house.

It started innocently.

“It’s so much space for just one person, Harper,” my mother would say when she visited.

Or my father would ask, “Do you really need a home office and a guest room? You’re hardly ever here.”

He was right about one thing. My job at North Bay Compliance Group requires travel. I spend about ten days a month on the road auditing satellite offices across the United States and ensuring corporate adherence to federal regulations. My house sits empty for a third of the month.

To me, that empty house was a sanctuary waiting for my return. To my parents, apparently, it was a wasted resource. It was a factory with the machines turned off.

I walked over to the fridge and pulled out a bottle of water. My hands were steady now. The shock of seeing the locksmith had burned off, replaced by the cold, hard clarity of my profession.

I deal with rules. I deal with contracts. I deal with people who think they can bend the line between “theirs” and “ours” without consequences.

At North Bay, when a manager tries to expense a personal vacation as a business trip, they always have a justification. They always say they earned it or that it doesn’t hurt anyone.

My parents were doing the same thing.

They had convinced themselves that because they helped me start, they owned the finish line.

They had mentioned Gavin Holt about two months ago. My father met him at a seminar titled “Wealth Preservation for the Modern Retiree.”

I had looked him up on LinkedIn back then. His profile was a buzzword salad of “asset optimization” and “legacy building.” He wasn’t a real estate agent. He was a consultant. That meant he charged fees for advice that didn’t have to adhere to the strict ethical codes of a licensed realtor.

Gavin had obviously looked at my parents—anxious, aging, and asset‑rich on paper but cash‑flow poor—and seen a feast.

He had planted the seed.

Why let a three‑bedroom house in a prime Aurora ZIP code sit empty when it could be generating three thousand a month? Why let a daughter live for “free” in a family asset when that asset could pay for cruises and medical bills?

They had dehumanized me in their eyes and certainly in Gavin’s spreadsheets. I was no longer Harper Thompson, their daughter who had survived a divorce and built a career. I was just a non‑paying tenant. I was an inefficiency in their portfolio.

I thought about the scene on the driveway, the way my father had said, “Market is good.” He wasn’t speaking to me. He was quoting Gavin. The way my mother had photographed my living room—she wasn’t capturing memories. She was creating marketing content.

And that sign in the back of Gavin’s car—PRE‑LEASE TODAY—that was the detail that turned my stomach.

Pre‑lease means you secure a tenant before the unit is even available. It means they had probably already promised this house to someone. They might have taken a deposit. They were likely planning to present me with a done deal, a signed lease and a move‑out date, expecting me to fold because “family helps family.”

They thought they could pressure me. They thought that because I was their daughter, I would bow to their authority. They thought that because they were co‑signers, they were co‑owners.

But they forgot what I do for a living.

I walked back to the island and picked up my phone. I unlocked it and looked at the banking app again.

I could have called my parents. I could have cried and begged them to respect my boundaries. I could have tried to appeal to their love for me.

But I knew that would fail.

You cannot use logic to fight greed, and you cannot use emotion to fight entitlement.

My parents had already justified this moral breach to themselves. They had rewritten the narrative so that they were the victims—the “poor retirees” with a supposedly selfish daughter “hogging a gold mine.”

If I argued with them, it would just be a family squabble. It would be he said, she said.

I needed a higher power.

I needed an authority that didn’t care about family dynamics, retirement anxiety, or equitable feelings.

I needed an entity that cared about one thing, and one thing only: the black‑and‑white reality of a contract.

I tapped the screen. The number for the customer service line of Harborstone Bank appeared.

I didn’t press the button immediately. I hesitated for exactly three seconds.

I knew that once I made this call, I was crossing a line. I was taking a private family betrayal and making it a matter of institutional record. I was potentially triggering a fraud investigation. I was likely destroying my relationship with my parents forever.

But then I looked at the front door. I looked at the wood shavings on the floor where the drill had bitten into the frame.

They had brought a drill to my home.

They were ready to physically breach my security to monetize my life.

They had declared war on my autonomy.

I pressed the call button.

The phone rang. It was that generic electronic trill that connects you to a call center somewhere in America.

“Thank you for calling Harborstone Bank,” a recorded voice said. “For English, press one.”

I pressed one.

“Please enter your sixteen‑digit account number or Social Security number,” the voice requested.

I entered my Social Security number, the one that was the primary identifier on the mortgage.

“Thank you, Harper,” the automated system said. “I see you are calling about your mortgage ending in 429. Is that correct?”

“Yes,” I said to the empty room.

“Please describe the reason for your call,” the voice asked.

I took a deep breath.

“I need to speak to the fraud department regarding unauthorized access and potential title fraud.”

The robot paused. It didn’t understand the nuance, but it understood the keywords.

“I am connecting you to a specialist. Please hold.”

Smooth jazz music began to play.

I walked over to the window and looked out at the street. The locksmith was gone. My parents were gone. Gavin was gone. The street looked peaceful—just a row of suburban houses under the Colorado sun.

But my world had shifted on its axis.

I was not just a daughter anymore.

I was the primary borrower, and I was about to defend my territory.

A human voice cut through the music.

“This is Sarah with the Harborstone security team. Can I have your full name for verification?”

“Harper Thompson,” I said, my voice steady, cold, and professional.

“Thank you, Ms. Thompson. I see you are the primary on the account. How can I help you today?”

“I need to verify the current status of my title and my authorized users,” I said. “And I need to know if anyone other than myself has attempted to make changes to the mortgage terms or access the equity in the last thirty days.”

There was the sound of typing on the other end.

“Okay, let me pull that up,” Sarah said. “It might take just a moment.”

I waited. The silence on the line was thick.

“That is interesting,” Sarah said after a moment. Her tone had shifted from polite to alert.

“What’s interesting?” I asked.

“Ms. Thompson, did you authorize a third‑party inquiry regarding a refinance application last week?”

My hand tightened around the phone.

“No,” I said. “I did not.”

“And did you authorize a request to change the mailing address for official correspondence to a P.O. Box in downtown Denver?”

“No,” I said. “I absolutely did not.”

“Okay,” Sarah said. “We have a problem.”

“Yes, Sarah,” I said, looking at the scar on my door. “We definitely do.”

I eventually hung up the phone with Sarah from the bank, my heart pounding a rhythm against my ribs that felt entirely foreign to the calm, collected person I usually was.

Sarah had flagged the account for suspicious activity and promised a full report within twenty‑four hours, but that wasn’t enough.

The digital evidence was damning, but I needed to see the physical reality of what they had done.

I walked into my home office.

This was my sanctum—the place where I worked late nights auditing complex compliance structures for American corporations. I knew every inch of this room. I knew exactly how I left my pens aligned on the desk and the specific angle of my monitor.

Something was wrong.

The bottom drawer of my filing cabinet was slightly ajar, just a fraction of an inch, but enough to catch my eye.

I walked over and pulled it open.

This was where I kept my personal financial records: tax returns, insurance policies, and the original closing documents for the house.

The hanging folders were messed up. I use a color‑coded system—blue for house, green for taxes, red for medical. The blue folders were pushed to the back, and the papers inside were not sitting flush.

Someone had pulled them out, leafed through them, and shoved them back in a hurry.

I felt a violation that was sharper than the drill on the front door.

They hadn’t just stood outside. They had been inside. They had used their spare key—the one I gave them for emergencies—to rifle through my private life.

My phone buzzed in my hand. It was a text from my mother.

Harper, please be reasonable. We have a showing scheduled for next Tuesday. You need to declutter the living room. It looks small with all your books.

I stared at the screen.

“We have a showing scheduled,” not “We want to schedule a showing.”

It was done. It was on a calendar somewhere. They were operating on a timeline that I wasn’t even supposed to know about until it was too late.

I didn’t text back.

I walked out of the office and into the living room—the space my mother thought looked small. It was spacious, filled with the sunlight that I paid for, the furniture I bought.

I needed to confront them, but not with emotion. I needed to confront them with the same cold, hard facts I used at work. I needed to know exactly what they believed they owned.

I heard a car pull into the driveway again.

They were back.

Of course they were back. They probably thought my “tantrum” had subsided and now they could come in and talk sense into me.

I opened the front door before they could even knock.

I opened the front door before they could even knock.

My father was leading the charge, his face set in a mask of grim determination. My mother trailed behind, looking anxious but resolute. Gavin Holt was with them too, of course, tapping away on his phone, looking up at the house like he was already calculating his commission.

“We need to talk, Harper,” my father said, stepping onto the porch. He didn’t try to come in this time. Maybe the look on my face stopped him.

“Yes,” I said. “We do.”

“You embarrassed us,” my mother said, her voice trembling. “Gavin is a professional. You treated him like a criminal.”

“I treated him like a trespasser,” I said. “Because that’s what he is.”

“I am a consultant,” Gavin said smoothly, slipping his phone into his pocket. “And I’m advising your parents on their rightful equity. Harper, you have to understand—in the state of Colorado, real estate law is complex. Beneficial interest is a real thing.”

“Beneficial interest,” I repeated. “Is that what you’re selling them, Gavin? That because they co‑signed, they have beneficial interest? They have an equitable stake?”

“Exactly,” Gavin said. He used the term with the confidence of someone who’d said it a thousand times to people who didn’t know any better. “They provided the creditworthiness. They provided the initial capital injection that creates a silent partnership.”

“A silent partnership,” I said. “And does this silent partnership give them the right to break my locks and list my home for rent without my consent?”

“It gives us the right to manage the investment,” my father shouted. “Stop playing word games, Harper. We put our names on the line for you. That house is as much ours as it is yours.”

“Is it?” I asked.

I pulled out my phone again. I didn’t open the banking app this time. I opened the Arapahoe County assessor’s website.

It’s public record. Anyone can look it up.

“I’m looking at the county property records right now,” I said, holding the phone up so they could see the county seal. “Parcel number 119730004. Owner of record…”

I paused.

The silence on the porch was deafening.

“Harper Thompson,” I read. “Sole owner. Vesting deed. Warranty deed recorded August fourteenth, 2020.”

I looked at my father.

“I don’t see ‘Dale Whitman.’ I don’t see ‘Marjorie Whitman,’ and I certainly don’t see ‘Gavin Holt Consulting.’”

My father faltered for a second. I saw doubt flash in his eyes. He looked at Gavin.

“Gavin said—” he started. “Gavin said he explained that the co‑signing creates an implied deed.”

“Implied deed,” I repeated. “Is that a legal term, Gavin, or is that something you made up to sell a seminar package?”

Gavin didn’t flinch. He was good.

“It’s a recognized concept in equity courts,” Gavin said. “Harper, you’re looking at the recorded title—that’s just administrative. We’re talking about the real ownership structure. The one that holds up when parents challenge children over unjust enrichment.”

“Unjust enrichment?” I laughed. “I pay the mortgage. I pay the taxes. I pay the repairs. Who’s being enriched here?”

“We’re securing our future,” my mother cried. “We gave you that down payment. We helped you when you had nothing. Now you want to cut us out when the property has value. That’s wrong, Harper.”

“Mom,” I said, my voice softening just a fraction. “Who told you that? Who told you that me keeping my own house is wrong?”

She pointed a shaking finger at Gavin.

“He showed us the charts,” she said. “He showed us how much equity is sitting there. He said you’re sitting on our retirement.”

“‘Our,’” I repeated.

“Show me,” I said to Gavin. “Show me the paper that says they own this house. You showed the locksmith a photocopy. Show me the original.”

Gavin hesitated.

“The documents are in my office safe,” he said. “For security.”

“That’s not how this works,” I said. “You’ve got a clipboard right there. You’ve got a file in your car. Show me what you have right now.”

He sighed—an exaggerated sound of patience being tested. He reached into his briefcase and pulled out a folder. He handed me a sheet of paper.

It was a photocopy of the deed of trust, but it was heavily redacted. Lines were blacked out, and highlighted in neon yellow was the section on guarantor responsibilities.

“This is the mortgage note,” I said. “This is the debt. This isn’t the deed. This says if I don’t pay, you have to. It doesn’t say you own the house.”

“Read the addendum,” Gavin said, pointing to a fuzzy paragraph at the bottom that looked like it had been pasted on from another document.

I squinted at it. The font was different. It was pixelated.

It read: “Guarantor retains executive management rights in event of equity surplus.”

“This isn’t real,” I said, looking up at him. “This is cut‑and‑paste. You literally stuck this onto a photocopy.”

“It’s a standard rider,” Gavin insisted, but his eyes darted to the street.

I looked at my parents. They were watching me, desperate for me to believe it, because if they didn’t believe it, they had to admit they were trying to take something that wasn’t theirs.

They were clinging to this fake piece of paper because it gave them permission to be greedy without feeling guilty.

“Dad,” I said. “Look at this. The font is Times New Roman. The rest of the document is Arial. He pasted this on.”

“Gavin is an expert,” my father snapped. “He knows the forms better than you.”

“Does he?” I asked. “Does he know that I work in compliance? That my entire job is spotting fraudulent documents?”

I handed the paper back to Gavin.

“This is forgery,” I said. “Sloppy, amateur forgery.”

“You are overreacting,” Gavin said, his smile thinning. “We are trying to help you maximize your position. If you want to play hardball, we can petition for a forced sale. Your parents have rights.”

“Rights?” I said. “You keep using that word.”

I looked at my mother.

“You said you have a showing next week. Who is coming?”

“A nice couple,” she said, defensive. “They work in tech. They are willing to pay thirty‑two hundred. They already sent a deposit to Gavin to hold the property.”

My blood ran cold.

“They sent money to Gavin,” I said.

“It’s a holding fee,” Gavin said quickly. “Standard industry practice. It goes into escrow.”

“Which escrow?” I asked. “What is the license number of the escrow company?”

“It’s internal escrow,” Gavin said.

“Internal escrow,” I repeated. “So your bank account.”

I looked at my parents. They didn’t see it. They didn’t see that they were the marks. They thought they were being savvy, but they were the ones being used.

Gavin wasn’t just trying to take my house. He was collecting money from strangers using my house as the lure, and he was using my parents to facilitate it.

“I’m not arguing with you anymore,” I said. “I’m not going to debate fonts or equitable interest or ‘internal escrow.’”

“Good,” my father said, puffing up his chest. “Then you’ll sign the lease management agreement.”

“No,” I said.

I held up my phone. The screen was still glowing.

“I’m calling Harborstone Bank again,” I said. “And this time I’m putting it on speaker.”

“Don’t you dare,” Gavin said, taking a step toward me.

“Step back,” I warned him. “Or I add ‘harassment’ to the list of issues.”

I pressed the call button. I had the direct line to the fraud department now.

“Harborstone Fraud Prevention. This is Agent Miller.”

A voice boomed from the speaker.

“This is Harper Thompson,” I said. “I’m standing here with two individuals who claim to have an equitable interest in my property and a third individual who has accepted a deposit for a rental lease on my home without my consent. I need you to tell them, on the record, who holds the title to the property at 1244 Maple Drive.”

My parents froze. Gavin looked like he wanted to run.

“One moment, Ms. Thompson,” Agent Miller said.

The sound of keys clacking was loud and clear.

“According to our records and the county recorder,” Miller said, “the sole title holder is Harper Thompson. There are no other authorized parties on the title. Any attempt to lease or encumber this property without your signature is invalid and may constitute mortgage fraud.”

I looked at my father.

“Did you hear that, Dad? Mortgage fraud.”

“But the co‑sign—” my father stammered at the phone.

“Co‑signing is a liability obligation, sir,” Agent Miller said, his voice crisp. “It confers no ownership rights. If you are attempting to assert ownership based on guarantor status, you are misinformed. If you are collecting money on this property, you may be exposing yourself to serious legal consequences.”

The phrase “legal consequences” hung in the air like a blade.

Gavin turned pale.

“This is a misunderstanding,” he muttered. “The bank doesn’t understand the creative structure we are building.”

“The bank understands the law, Gavin,” I said. “And right now, the law is looking at you.”

The speakerphone in my hand crackled, the only sound in the suffocating silence of my front porch.

“Ms. Thompson,” Agent Miller continued. “Since we are discussing unauthorized activity, I need to verify a recent application associated with this account. Can you confirm if you initiated a refinance request on the twelfth of this month?”

The question hit me like a physical blow.

A refinance.

I had a fixed rate of 2.8 percent. Refinancing in the current market—over seven percent—would be financial suicide. It would nearly double my monthly payment for absolutely no benefit unless the goal was to pull cash out.

“No,” I said, my voice dropping to a whisper. “I did not.”

“And did you authorize a request to add a secondary title holder to the deed?” Miller asked.

I felt the blood drain from my face.

“No,” I said. “Absolutely not.”

“Okay,” Miller said. “We have a pending application in our system. It was submitted through a third‑party broker channel. The applicant is listed as Dale Whitman.”

I slowly turned my head to look at my father.

Dale Whitman—the man who taught me to ride a bike, the man who always lectured me about integrity and doing things the right way—was staring at a spot on the stucco wall just above my left shoulder. He wouldn’t look at me. He couldn’t.

His jaw was clenched so tight I could see the muscle jumping under his skin.

My mother, Marjorie, let out a small, strangled sound. She gripped her phone with both hands, her knuckles white. She looked at my father, then at me, her eyes wide with a mix of panic and defiance.

“Dad,” I said. The word felt heavy, like a stone in my mouth.

He didn’t answer.

“Mr. Whitman is listed as the co‑borrower on the current loan,” Agent Miller’s voice continued from the phone, oblivious to the family implosion happening on my porch. “However, he does not have the authority to initiate a refinance or a title change without the primary borrower’s notarized consent. The application included a signature that purports to be yours, Ms. Thompson.”

A signature.

“I didn’t sign anything,” I said, staring at my father. “Did I, Dad?”

My father finally looked at me. His eyes were hard, defensive.

“It was just paperwork, Harper,” he said. “Preliminary paperwork to explore options.”

“Options?” I repeated. “Forging my signature is an option?”

“We were going to tell you,” my mother burst out. “It was for the business plan. Gavin said we needed to unlock the equity to fund the rental upgrades and cover the management fees. It was just a temporary move, Harper. We would have paid it back from the rental income.”

“You were going to mortgage my house,” I said, the reality sinking in. “You were going to take out a loan against my home at three times the interest rate without telling me.”

“To improve the asset,” my father shouted, finally finding his voice. “To make it profitable. You’re sitting on two hundred thousand dollars of unused equity. It’s irresponsible.”

“It’s my equity,” I yelled back. “Mine. Not yours. Not ‘the family’s.’ Mine.”

“Ms. Thompson,” Agent Miller interrupted, his tone shifting from informative to urgent. “If you are stating that you did not sign this application, we are looking at identity theft and bank fraud. I am transferring you to our escalated fraud prevention unit immediately. Do not hang up.”

The line clicked and hold music started playing again. It was a cheerful, upbeat tune that felt grotesquely out of place.

Gavin stepped forward. The smirk was gone. In its place was a look of calculated menace.

“Harper,” he said, his voice low. “Hang up the phone.”

“No,” I said.

“You are making a mistake,” Gavin said. “You are blowing this out of proportion. This is a family disagreement. You don’t involve the bank in a family disagreement. You don’t file fraud reports against your own father.”

“My father didn’t just have a disagreement with me,” I said. “He tried to take my house, and you helped him.”

“I advised on strategy,” Gavin said quickly. “I didn’t sign anything. If Dale submitted paperwork, that’s on him. But think about what you’re doing. Do you really want to see your father in handcuffs over a signature?”

“It’s not just a signature, Gavin,” I snapped. “It’s my life. It’s my credit. It’s my home.”

“It’s a misunderstanding,” my mother pleaded. She reached out to grab my arm, but I stepped back.

“Harper, please. We can fix this. We can withdraw the application. Just hang up. Don’t let them open a file.”

“It’s too late, Mom,” I said. “The file is already open. The bank knows.”

“You are ruining us,” my father roared. “After everything we did for you. We co‑signed when no one else would. We gave you the start, and this is how you repay us? By calling fraud investigators?”

“I’m protecting myself,” I said. “I’m stopping you from making this worse.”

The hold music stopped. A new voice came on the line.

“This is senior investigator Davis with Harborstone Fraud Prevention,” the voice said. “I understand we have a potential forgery involving a refinance application.”

“Yes,” I said, my eyes locked on Gavin’s too‑shiny suit. “My name is Harper Thompson. I am the homeowner. I am standing here with the individuals who submitted the application without my knowledge. They are acknowledging it right now.”

“Ms. Thompson, are you in a safe location?” investigator Davis asked.

“I’m on my front porch,” I said. “I’m safe, but my credit is not.”

“Understood,” he said. “I need you to confirm you did not sign a uniform residential loan application dated November twelfth.”

“I did not,” I said.

“Did you sign a quit claim deed or any instrument transferring title?”

“No.”

“Okay. We are freezing all activity on this account immediately. We will be flagging the application as fraudulent. This will trigger an automatic notification to the credit bureaus and relevant reporting agencies.”

“Good,” I said.

My mother let out a soft cry.

“Ms. Thompson,” investigator Davis continued, “we will need you to file a police report to support the fraud claim. Without a police report, it is difficult to permanently block the other parties if they claim authorization. Are you willing to do that?”

I looked at my parents. My mother was crying openly now, her face buried in her hands. My father looked older than I’d ever seen him, defeated and terrified.

And Gavin—

Gavin was slowly backing away toward his car.

“Yes,” I said into the phone. “I am willing to do whatever it takes.”

“Harper, don’t,” Gavin warned. “You are opening a door you can’t close. Family is family.”

“Gavin is right about one thing,” I said to the investigator, but loud enough for them to hear. “Family can say whatever they want. They can say it was a misunderstanding. They can say it was for my own good. But the bank doesn’t care about feelings. The bank only cares about the trail.”

I looked straight at my father.

“And you left a trail, Dad. You signed my name. You tried to refinance my home to pay this ‘consultant,’ and now the bank is going to follow that trail all the way to the end.”

“Please,” my father whispered. It was the first time I’d ever heard him beg.

“I’m sorry, Dad,” I said. “But you didn’t ask me. You didn’t ask if I wanted to be part of your plan. You just acted. Now I’m acting too.”

“Investigator Davis,” I said clearly, “please tell me the next step. I’m ready to write it all down.”

The silence that followed my conversation with the bank investigator was not peaceful. It was heavy, suffocating, and filled with the invisible debris of a family breaking apart in real time.

I ended the call, slipped my phone back into my pocket, and looked at the three people standing on my porch. They looked like statues carved out of guilt and panic.

My mind, trained by years of auditing corporate compliance failures, began to arrange the chaotic fragments of the morning into a coherent timeline.

This was not a sudden impulse. My parents did not wake up this morning and decide to drill my locks. This was a carefully cultivated disaster.

I looked at my father. He was staring at his shoes. His posture had slumped. The arrogance he’d displayed ten minutes ago—the “market is good” bravado—had evaporated, leaving behind a frightened old man.

“Why?” I asked.

It was a simple question, but it carried the weight of four years of trust.

“Why did you need the money so badly that you were willing to risk all of this?”

My mother sniffed, wiping her eyes with a tissue she pulled from her sleeve.

“We didn’t think it was a crime, Harper,” she said. “Gavin explained it. It was asset utilization.”

“Stop using his words,” I snapped. “Tell me the truth. Is it the retirement fund?”

My father sighed—a ragged sound.

“The market correction last year hurt us,” he said. “The bond portfolio is down. Everyday prices keep rising. We did the math. At this rate, we run out of money in seven years.”

“So you panicked,” I said.

“We were looking for solutions,” my father said defensively. “We went to a seminar. The Rocky Mountain Retirement Strategy Group.”

“Let me guess,” I said, turning my gaze to Gavin, who was now leaning against the porch railing, trying to look unbothered, but failing. “Gavin was the keynote speaker.”

“He was a guest lecturer,” my mother said. “He talked about the hidden wealth in the family unit. He said that too many retirees sit on the sidelines while their children sit on hundreds of thousands of dollars of equity that the parents helped create. He called it the ‘generational ledger.’”

“He said that morally the equity belongs to the creators of the credit profile,” my father added. “That’s us, Harper. We gave you the credit profile.”

I felt a wave of nausea.

It was a script. A sales pitch.

“So you joined his program,” I said. “And what does the program teach? Does it teach you to forge signatures?”

“It teaches leverage,” Gavin said, his voice tight, the smooth salesman veneer cracking. “We teach families how to pool resources. Your parents were just trying to execute a liquidity event to secure their future. If you weren’t so focused on control, you’d see that this benefits everyone. You get the house paid off faster with the rental income. They get a management fee.”

“I don’t need a management fee,” I said. “I have a job. A job that pays the mortgage.”

“And what happens when you lose that job?” my father asked, grasping for a foothold. “What happens if the economy turns? We were building a safety net.”

“You were building a trap,” I said. “And you stepped right into it.”

“What else did you sign?” I asked. “You signed the refinance application. What else?”

My father shifted his weight.

“Just standard representation agreements,” he said. “Power of attorney for property management.”

“Power of attorney?” I almost shouted. “You gave him power of attorney over my house?”

“Limited,” my mother cried. “Limited to the investment property. It’s not—”

“It’s not an investment property,” I yelled. “It is my home.”

My phone pinged. Then it pinged again. And again. A rapid‑fire succession of notifications that made my heart stop.

I pulled the phone out.

It wasn’t a text from a friend. It was an email notification from a platform called RentFast.

Subject: Your listing is live.

“Twinkle44—Maple Drive is now viewable by thousands of renters.”

I stared at the screen.

“You listed it?” I whispered. “You actually listed it.”

“We had to,” my mother said, her voice rising. “To show the bank the projected income. Gavin said we needed a live listing to qualify for the bridge loan.”

I scrolled down. There was another email—a direct message from the platform.

From: MarkS88.

Message: Hi Dale, just wanted to confirm you received the holding deposit. My wife and I love the place. We’re ready to move in on the first. Attached is the Zelle receipt.

I opened the attachment.

It was a screenshot of a digital transfer.

Amount: $2,500.

Recipient: GHC Consulting LLC.

Memo: Deposit for Maple Drive.

The world seemed to tilt.

This wasn’t just about refinancing anymore. This wasn’t just about intent. They had taken money. They had taken $2,500 from a stranger named Mark, promising him a home that was not theirs to give.

I held the phone up to Gavin’s face.

“You took a deposit,” I said.

“It’s a refundable holding fee,” Gavin said. “Standard practice to vet serious inquiries.”

“You took $2,500 for a property you do not own,” I said, my voice shaking with anger. “That is deception. That is a big problem.”

“It’s escrow,” Gavin insisted. “It goes into the project account.”

“What project account?” I demanded. “The one you control? The one my parents don’t have access to?”

I turned to my parents.

“Did you know he took money?” I asked.

My father looked confused.

“He said—he said there were fees. Application fees. I didn’t know he took a deposit yet.”

“He took $2,500, Dad,” I said. “And where do you think that money is right now? Do you think it’s in a safe account, or do you think it’s paying for that silver sedan he drove up in?”

My mother gasped.

“Gavin, you said the money goes to the mortgage payment,” she said.

“It will,” Gavin snapped, losing his calm. “Once the structure is finalized. You people are so impatient. You don’t understand how complex these deals are.”

“I understand exactly what this is,” I said. “It’s a con. You use the refinance money to pay the returns to early participants, and you use the rental deposits to keep everyone quiet until the bank notices. And when everything falls apart, who’s left holding the bag?”

I pointed to myself.

“The name on the deed,” I said. “Me.”

I looked at the message from Mark again.

“This poor guy,” I said. “He thinks he has a home. He’s probably packing boxes right now.”

I started typing a reply.

“What are you doing?” Gavin stepped forward, his hand reaching out as if to grab the phone.

I stepped back, raising my other hand.

“I’m replying to Mark,” I said. “I’m telling him that he has been misled. I’m telling him that the person who took his money does not own this house.”

“Don’t,” Gavin hissed, his eyes dark. “You do that, and you trigger a lawsuit. I will bring claims. I will bring claims against your parents. You will bankrupt them, Harper. Is that what you want? You want to see your parents lose their own house because you couldn’t stay quiet?”

“You are threatening me?” I asked.

“I am stating facts,” Gavin said. “We have a signed agreement. Your parents authorized me to act. If you blow this up, the liability falls on them. I am protected. They are the ones who claimed ownership.”

My father looked at Gavin, horror dawning on his face.

“Gavin, you said you handled the risk,” my father said.

“I handled the strategy, Dale,” Gavin sneered. “You handled the representations. You told me you had the authority. If you misstated that, that’s your problem.”

The cruelty of it took my breath away. He was turning on them instantly, using the very lines he’d sold them to trap them.

“Get out,” I said.

“We’re not done,” Gavin started.

“Get out,” I screamed.

The sound tore from my throat, raw and primal.

“Get off my property. If you’re not gone in thirty seconds, I’m calling the police, and I’m showing them this receipt.”

Gavin looked at me, then at my parents. He sneered—a look of pure contempt.

“Fine,” he said. “Enjoy your empty house. You deserve each other.”

He turned and walked to his car. He didn’t run. He walked with an arrogant swagger, as if he’d already won because he had the money in his pocket.

I watched him drive away.

The silence rushed back in, but this time it was different. It was the silence of a bomb site after the explosion.

My mother was sobbing quietly. My father was leaning against the wall, looking like he might collapse.

“Harper,” my mother whispered. “What have we done?”

“You tried to trade my home for your comfort,” I said coldly. “You tried to trade my life for your retirement.”

“We just wanted to be secure,” my father croaked. “We just wanted to help.”

“No,” I said. “You wanted control. And now you’re losing it.”

I looked at my phone.

I sent the message to Mark.

I am the owner of 1244 Maple Drive. I did not authorize this listing. Please contact your bank immediately to reverse the payment. Do not send any more money.

I looked at my parents.

“I’m not done,” I said. “The bank knows. The renter knows. Now I need to make sure the county knows.”

“The county?” my father asked weakly.

“I’m going to the recorder’s office,” I said. “I’m going to pull every single document filed against this property in the last six months. If Gavin filed a lien, if he filed a fake deed, if he filed anything, I’m going to find it.”

“Harper, please,” my mother begged. “Can’t we just stop? Gavin is gone. We won’t do it again.”

“You don’t get to decide when this stops,” I said. “You lost that right when you gave a stranger the keys to my life.”

I walked past them into the house and grabbed my purse and car keys.

I didn’t ask them to leave. I didn’t care if they stayed on the porch all day. They were ghosts to me now.

“Where are you going?” my father asked as I brushed past him.

“I’m going to check the public record,” I said. “Because clearly I cannot trust the private word of my own family.”

I got into my car. My hands were shaking so hard I had trouble putting the key in the ignition. But I forced myself to breathe in… out.

I had stopped the drilling. I had stopped the refinance—for now.

But Gavin’s words about agreements and “protection clauses” were ringing in my ears.

He was too confident.

He had something else.

I put the car in reverse and backed out of the driveway, leaving my parents standing there, small and shrinking in my rearview mirror.

I drove toward the county administration building. I had a sick feeling in the pit of my stomach that the drilling on the lock was the least of the damage they had done.

The real damage was on paper.

Buried in the stacks of the clerk and recorder’s office.

Waiting for me to find it.

The Arapahoe County Clerk and Recorder’s office smelled like floor wax and bureaucracy. It was a smell I usually associated with order—clear titles, stamped deeds, the quiet certainty of ownership in the United States.

But today, standing at the counter under the fluorescent lights, it felt like a waiting room for a diagnosis I didn’t want to hear.

“I need a complete history for parcel 119730004,” I told the clerk. “Everything filed in the last twelve months—liens, deeds, encumbrances, affidavits. Everything.”

The clerk, a woman with kind eyes and efficient hands, typed the parcel number into her terminal.

“Just a moment,” she said. “The system is a little slow today.”

I drummed my fingers on the countertop.

My phone buzzed in my pocket. It was my father, then my mother, then my father again.

I didn’t answer.

I had silenced the ringer, but the phantom vibration against my thigh felt like a constant reminder of the chaos waiting for me outside.

“Here we go,” the clerk said.

The printer whirred to life.

“Looks like mostly standard stuff,” she said. “The original deed from 2020, tax assessments… oh, wait.”

My heart hammered.

“What?” I asked.

“There’s a ‘notice of commencement’ filed about three weeks ago,” she said, pulling a sheet from the tray. “For interior renovation and security upgrades. Contractor listed is GHC Renovations.”

“GHC,” I repeated slowly. “GHC… as in GHC Consulting?”

“Looks like it,” she said.

I took the paper. It was signed—or rather, it had a scribble that looked vaguely like my signature.

“Is that it?” I asked, my voice tight.

“That seems to be the most recent,” she said. “Nothing else has been recorded yet. Sometimes there’s a lag if they e‑file.”

“Thank you,” I said.

I took the stack of papers.

A construction notice.

He had filed a document saying he was doing work on my house. That was the first step to filing a mechanic’s lien if he wasn’t paid.

It was a trap.

If I sold the house, I’d have to pay him. If I refinanced, I’d have to pay him. He had attached himself to my property like a parasite.

I walked out to my car, the papers clutched in my hand like a weapon.

The sun was starting to dip, casting long shadows across the parking lot.

I drove home. The drive was a blur of traffic lights and anxious thoughts.

I needed a lawyer. I needed someone who dealt with this kind of real estate mess for a living.

When I pulled into my driveway, the house looked the same as I had left it, but the energy was different. My parents were gone. The silver sedan was gone, but the violation lingered.

I walked to the mailbox. I usually check it every few days, but today I felt a compulsion to look.

There was a white envelope from the United States Postal Service. Official mail.

I tore it open right there on the sidewalk.

Confirmation of change of address request.

Old address: 1244 Maple Drive, Aurora, CO.

New address: P.O. Box 892, Denver, CO.

Requester: Marjorie Whitman.

I stared at the paper.

My mother—my own mother—had tried to divert my mail. She wanted to hide the bank notices. She wanted to hide the tax bills. She wanted to make sure I never saw the letters that would warn me about what they were doing.

It was so calculated.

There was another envelope in the mailbox. Thick manila, with no return address, just a stamp.

I opened it.

Inside was a lease agreement. A draft.

Residential Lease Agreement.

Landlord: Dale and Marjorie Whitman.

Tenants: Mark and Sarah Stevens.

Monthly rent: $3,200.

Term: Twelve months.

It was filled out. The names were typed in. The dates were set for the first of next month.

My hands shook.

They were going to sign this. They were going to let these people move in.

If I hadn’t come home early from the gym, if I hadn’t seen the locksmith, I might have come home next week to find strangers in my living room, holding a lease signed by my parents.

I walked inside and went straight to my laptop. I didn’t take off my shoes. I didn’t get a glass of water. I sat down and started typing.

“Real estate attorney Aurora fraud litigation.”

I found a name:

Elena Rodriguez.

Top‑rated. Aggressive defense of property rights.

I called her office. It was 5:15 p.m., but someone answered.

I explained the situation in two minutes: unauthorized listing, forged attempts, mail diversion, co‑signers claiming ownership.

“Stop talking,” Elena said after I finished my rapid‑fire summary. “You need to lock everything down right now.”

“I called the bank,” I said. “Fraud prevention is freezing the account.”

“Good,” Elena said. “Now you need to lock the title. Go to the county site and sign up for title alerts or whatever system they have. It will email you if anything new is recorded. Second, get an affidavit of forgery drafted. You’ll need to file that with the county to cloud any document they might try to record. Third, change all your passwords—email, banking, utilities. If your mother tried to change your address, she probably has your Social Security number and your mother’s maiden name, which is her name, right?”

“Right,” I said, feeling stupid for not thinking of that. “She knows everything.”

“She is your mother,” Elena said, her voice softening slightly. “She knows your first pet, your high school mascot, the street you grew up on. She is the ultimate security breach. You need to treat her like a hacker.”

“Okay,” I said. “I’ll do it.”

“And Harper,” Elena added, “do not engage. Do not talk to them. Do not reply to texts. Save everything—screenshots, voicemails. If they show up, call the police. You are in litigation mode now. Family time is over.”

I hung up and started the checklist.

Title alerts—activated.

Passwords—changed to random strings of characters I stored in a physical notebook.

Security questions—updated to fake answers. My mother’s maiden name was now “Godzilla.”

My phone buzzed again.

A text from my father.

Harper, please pick up. Mom is really upset. You are destroying us. We can’t pay Gavin back the deposit if the deal falls through. We spent the operating capital on the setup fees.

I read it twice.

They had already spent money. They had paid Gavin’s “setup fees.” That was where the $2,500 went—or maybe more. They were in the hole and blaming me for not letting them dig deeper.

I didn’t reply. I took a screenshot. Evidence.

Another text. This time from my mother.

We just wanted to build something for the family. Why are you being so harsh? You have a good job. You don’t need the equity like we do. You are ruining our future.

“The future,” I said to the empty room. “You can’t build a future on someone else’s house.”

I took another screenshot.

Then a text from a number I didn’t have saved, but I knew who it was.

You are playing a dangerous game. Making a formal report will damage your parents’ credit and reputation. Is that what you want—to be the daughter who brought that down? Let’s meet. We can work out a settlement, a retroactive authorization. Don’t make this ugly.

Gavin.

“Don’t make this ugly,” I whispered. “You drilled a hole in my door.”

I didn’t reply. I took a screenshot.

I printed the screenshots. I printed the email about the address change. I printed the lease draft.

I started a physical file on my desk.

The case against my parents.

The sun went down. The house was dark, but I didn’t turn on the lights. I sat in the glow of my monitor, watching fraud‑alert emails from my bank trickle in.

Alert: attempted login from unrecognized device.

Alert: password reset requested for utility account.

They were trying to get back in. They were trying to regain control.

It was frantic. Desperate.

I felt a cold resolve settle in my chest.

I wasn’t scared anymore. I was angry.

And I was prepared.

I opened a new document on my computer.

I typed the header:

AFFIDAVIT OF FORGERY.

“I, Harper Thompson, being first duly sworn, state and affirm…”

I typed out the truth—that I was the sole owner, that I had never authorized Dale or Marjorie Whitman to act as my agents, that the signature on the notice of commencement was not mine.

I was ready to sign it. I was ready to notarize it. I was ready to file it with the county and make it public record that my parents had gone too far.

It felt like cutting off a limb—but the limb was infected. If I didn’t cut it off, it would take everything with it.

My phone rang.

It was the fraud prevention unit again.

“Ms. Thompson,” the agent said. “We have an update. We traced the IP address of the refinance application. It originated from a computer registered to a business entity, GHC Wealth Management.”

“Gavin,” I said.

“And,” the agent continued, “we have a recorded call from our verification line. Three days ago, a female voice claiming to be ‘Harper Thompson’ called to verify the loan balance.”

“A female voice?” I repeated.

“It wasn’t you, Ms. Thompson,” the agent said. “The voice was older.”

My mother.

She had called my bank. She had used my information and pretended to be me.

“Send me the recording,” I said. “I want to hear it.”

“We will include it in the file for the police report,” the agent said.

“Thank you,” I said.

I hung up.

I looked at the file on my desk.

It was getting thicker.

I walked to the window and looked out at the street. A car slowed down in front of my house—a silver sedan. It paused for a moment, then sped up and drove away.

He was watching. He was checking to see if I had folded.

I walked to the front door and threw the deadbolt. The mechanism the locksmith had started to replace still worked from the inside.

“Come back,” I whispered. “I dare you.”

I wasn’t just a daughter anymore.

I was a plaintiff.

And I was going to win.

The email arrived at 4:45 in the afternoon.

It was a standard automated notification from the Arapahoe County clerk system—the title alert service I’d activated only hours before on Elena’s advice.

The subject line was simple.

Activity Alert – Parcel 119730004.

I was sitting at my kitchen table, nursing a cup of coffee that had gone cold an hour ago. The house was quiet, but it was a hostile quiet. Every creak of the floorboard sounded like an intrusion.

I clicked the link in the email, my finger trembling slightly.

The document loaded on my laptop screen. It was a PDF, scanned in high‑contrast black and white. At the top, stamped in heavy ink, was the recording date: November fourteenth.

Twelve days ago.

I gripped the edge of the table.

Twelve days ago, I was in Chicago, auditing a pharmaceutical company. I was sitting in a conference room eating a stale bagel while my parents were apparently signing something that changed my ownership.

I scrolled down.

The document title was centered and bold:

QUIT CLAIM DEED.

I read the text, my breath catching.

Grantor: Harper Thompson.

Grantees: Harper Thompson and Dale Whitman and Marjorie Whitman, as joint tenants with rights of survivorship.

Joint tenants.

That meant equal ownership. That meant if I died, they got the house automatically. That meant, on paper, they owned 100 percent of the property as much as I did.

They hadn’t just added themselves as managers.

They had given themselves my house.

And then I saw it.

At the bottom of the second page, above the line labeled “Grantor Signature,” was my name.

Harper Thompson.

I stared at it until my eyes burned.

It looked like my signature. It had the same loop on the “H.” It had the same sharp strike on the “T.” To a bank teller or a clerk, it would look perfect.

But I knew every quirk of my own handwriting. I knew that I never connected the “r” and the “p” in Harper. I knew that my signature always slanted slightly to the right.

This signature was upright. It was stiff. It was a drawing of my signature, not my actual hand.

I looked at the notary block.

Subscribed and sworn to before me this 14th day of November.

Notary Public: Jennifer A. Lintz.

Commission—State of Colorado.

I did not know a Jennifer A. Lintz. I had never stood before her. I had never raised my right hand and sworn anything to her.

This wasn’t a misunderstanding. This wasn’t “getting things ready.” This was a completed act.

In the eyes of the record, they had already changed my title.

I grabbed my phone and dialed Elena Rodriguez.

“They did it,” I said the moment she picked up. “Elena, they recorded a quit claim deed twelve days ago.”

“Send it to me,” Elena said, her voice sharp. “Right now.”

“I’m emailing it,” I said, hitting forward. “It has my signature on it, Elena—but I was in Chicago. I have flight logs. I have hotel receipts.”

“Okay,” Elena said. “Listen to me closely. This changes the posture of the case. We are not just preventing fraud anymore. We are unwinding it. This is a cloud on the title.”

“What does that mean?” I asked.

“It means that until a judge signs an order declaring that deed void, your parents legally appear as joint owners,” Elena said. “It means they can try to borrow against it. They can try to grant leases. They can attempt to sell an interest. We have to file a lis pendens immediately. That’s a notice of pending litigation. It warns any potential lender or buyer that the title is in dispute.”

“Do it,” I said.

“And Harper,” Elena added, her voice dropping, “you need to contact your title insurance company. When you bought the house, you purchased an owner’s policy. This is exactly what it’s for. Forgery is a covered event. But you need to be prepared for what happens next.”

“What happens next?” I asked.

“Once the title insurer gets involved, they’ll launch their own investigation,” Elena said. “They don’t care about family dynamics. If they pay a claim to fix this, or if they have to defend your title in court, they will go after the people responsible to recover their costs. That means your parents and anyone who helped them.”

“Good,” I said.

The word tasted like ash.

“They changed my deed, Elena,” I said. “They actually changed it.”

“I’ll draft the complaint,” Elena said. “Stay safe. Don’t sign anything—not even a birthday card.”

I hung up.

I sat in the darkening kitchen for a long time. The house felt different now—like a stage set built on contested land.

I looked at the granite countertops I had chosen. I looked at the backsplash I had installed myself over a long weekend. Every inch of this place had my time and my money in it.

And with one piece of paper, they had tried to turn it into “our investment.”

I needed to look them in the eye.

I needed to see if they understood what they had done.

I didn’t call them.

I texted them one sentence.

Come to the house now. Bring the paperwork.

I didn’t wait for a reply. I knew they would come. They were desperate. They probably thought I was ready to surrender, ready to “listen to reason” to save the family name.

Twenty minutes later, I heard the familiar sound of my father’s SUV pulling into the driveway.

I didn’t meet them at the door this time.

I sat at the dining room table. I had the printed copy of the quit claim deed sitting in the center of the table, illuminated by the overhead light like an exhibit in a trial.

The front door opened.

My key still worked, which meant they hadn’t changed the locks yet.

They walked in.

My mother looked terrible. Her eyes were red, her face puffy. My father looked pale, his shoulders hunched.

They walked into the dining room and stopped when they saw me.

“Harper—” my mother started, her voice pleading. “Thank goodness. We were so worried. We thought you were going to do something rash.”

“Sit down,” I said.

They hesitated, then pulled out the chairs opposite me.

They looked like two children called into the principal’s office—terrified, but still clinging to the hope that they could talk their way out of trouble.

I didn’t say a word.

I reached out and slid the paper across the table.

My father looked down at it. I saw the recognition in his eyes. He didn’t look surprised to see the document. He looked surprised that I had it.

“You recorded it,” I said quietly. “On November fourteenth.”

“It was part of the package,” my father stammered. “Gavin said—to secure the financing—we needed to show chain of title. It was just a technicality, Harper. We were going to sign it back to you once everything was paid off.”

“You used my name,” I said. “On a deed. Without me there.”

“We didn’t,” my mother cried. “We would never—”

“Look at the paper, Mom,” I said, pointing at the signature line. “That says ‘Harper Thompson.’ I didn’t write that. So who did?”

My mother bit her lip. She looked at my father.

“It was authorized,” my father said, but his voice lacked conviction. “Gavin had a power of attorney form. He said since we are the senior partners in the investment group, we could sign on your behalf for administrative documents.”

“This isn’t an administrative document,” I said. “This is a deed. It transfers ownership. You can’t sign my name, Dad. You have to sign your name as ‘agent.’ This is different. Someone took a pen and tried to draw my signature.”

“That’s a serious offense in Colorado,” I added.

“We didn’t know,” my mother sobbed. “Gavin handled the paperwork. He brought it to us to sign our parts, and your name was already there. He said you had signed it digitally through the portal.”

“I never accessed a portal,” I said. “And the notary? Jennifer A. Lintz. Who is she?”

“She works with Gavin,” my father said. “She came to the house. We signed in the kitchen.”

“And was I there?” I asked.

My father’s eyes dropped.

“No,” he whispered.

“So you stood there,” I said. “In your kitchen. And you watched a notary stamp a document saying that I appeared before her when you knew for a fact I was in Chicago. You watched her lie. You watched her stamp something that wasn’t true. And you signed your names right next to it.”

“We thought it was standard procedure,” my father shouted, slamming his hand on the table, trying to regain control with volume. “Why are you twisting everything? We were trying to help you. We were trying to make something for all of us. Why do you care about the paperwork if the intent was good?”

“Because the paperwork is the only thing that matters,” I screamed back. “The paperwork says you own my house. The paperwork says I have fewer rights. You didn’t help me. You bypassed me.”

The room fell silent.

“It’s done now,” my father said, his voice dropping to a sullen mumble. “It’s recorded, so you might as well work with us. We can’t undo it without Gavin’s help. He holds the file.”